AI's Christmas Takeover: 75% of Shoppers Using ChatGPT and AI Tools to Find Gifts

75% of holiday shoppers are using AI for Christmas 2025, driving $263 billion in sales. Amazon Rufus generates $10 billion, ChatGPT attracts 250 million users, but a massive generational divide (73% Gen Z vs. 8% Boomers) reveals this is a 10-15 year demographic wave, not a 2-year revolution.

AI's Christmas Takeover: 75% of Shoppers Using ChatGPT and AI Tools to Find Gifts

As traditional holiday shopping transforms into an AI-driven marketplace, $263 billion in Christmas sales hang in the balance—and the companies winning this battle aren't the ones you'd expect

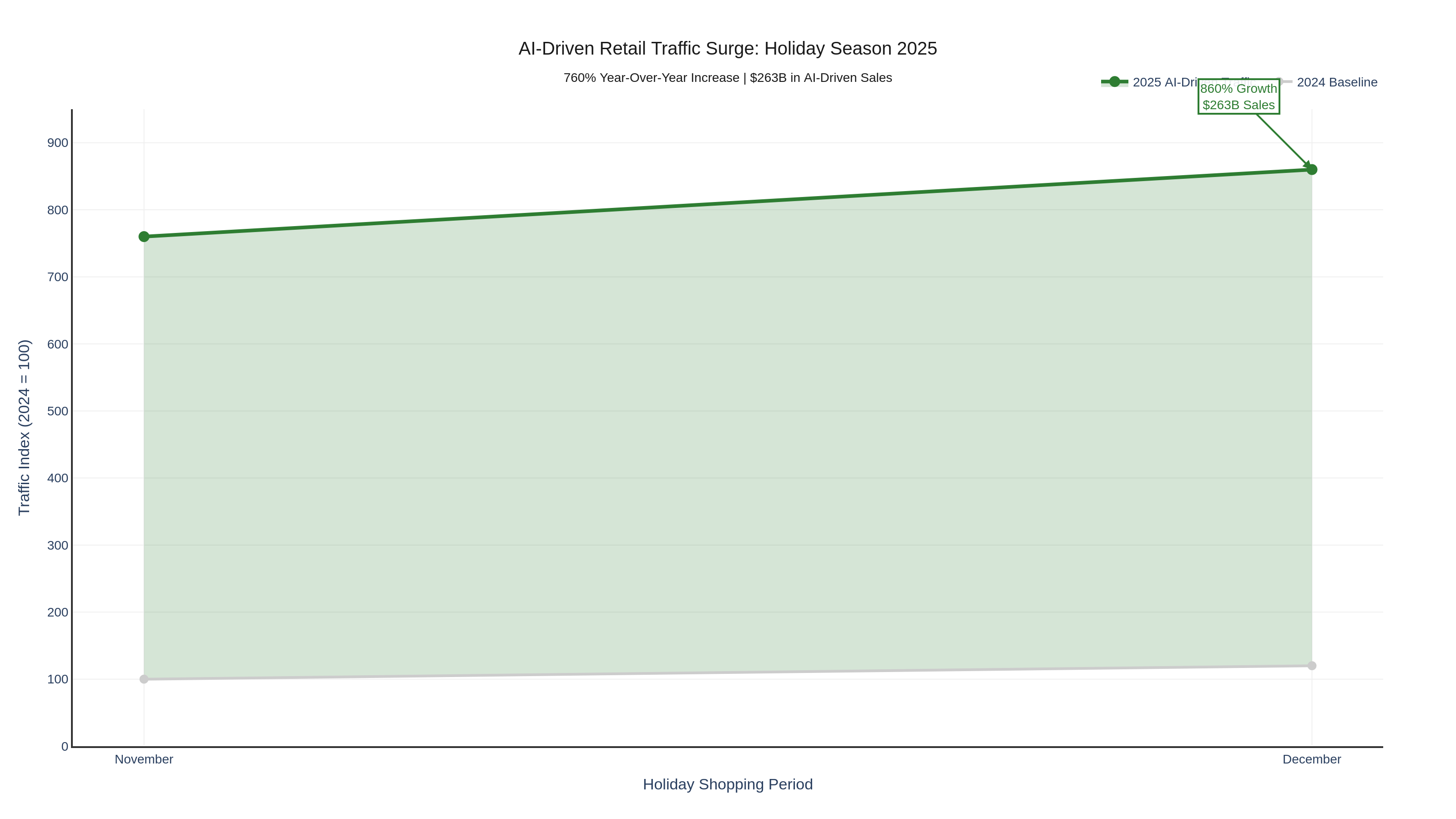

Christmas 2025 marks a watershed moment in retail history: For the first time, three out of four holiday shoppers are using AI to find gifts, compare prices, and make purchasing decisions. The numbers are staggering—a 760% year-over-year surge in AI-driven traffic to retail sites, with Salesforce projecting AI tools will influence $263 billion in global holiday sales this season alone.

But beneath these explosive growth figures lies a more nuanced story. While Amazon's Rufus chatbot drove $10 billion in sales and ChatGPT's shopping research feature attracted 250 million users, a significant generational divide is reshaping retail: 73% of Gen Z shoppers embrace AI gift discovery, while only 8% of Baby Boomers have adopted it. For investors, understanding who wins—and who loses—in this AI Christmas revolution is critical.

This isn't just about convenience. It's about a fundamental restructuring of retail economics—where the shift from Search Engine Optimization (SEO) to Answer Engine Optimization (AEO) is creating billion-dollar winners and forcing traditional retailers to overhaul their entire digital strategy.

The Numbers: AI's Christmas Miracle or Mirage?

The data paints a picture of explosive AI adoption—but with critical caveats that determine investment winners.

Adoption Rates by the Numbers

- 75% of consumers will use AI to find deals during Christmas 2025, up from 66% in 2024 (Talkdesk)

- 67% plan to use AI for gift ideas, up from 54% last year

- 40% of Americans have used AI for shopping in the past year (PayPal)

- 52% intend to use AI specifically for holiday shopping (Adobe)

- 13%+ are using ChatGPT for gift planning (multiple surveys)

But here's the critical detail Wall Street is missing: Survey data ranges wildly from 40% to 83% depending on how "AI usage" is defined. Clicking on an AI-powered recommendation vs. actively prompting ChatGPT for gift ideas are fundamentally different behaviors—and drive very different economics.

The Revenue Reality

- $263 billion in projected AI-influenced holiday sales globally (Salesforce)

- 21% of all holiday orders will involve AI in the purchase journey

- Shoppers from AI platforms are 30% more likely to purchase than traditional search users

- AI-referred shoppers generate 8% more revenue per session

- 8x higher conversion rates for AI traffic vs. social media (Adobe)

For context: $263 billion is roughly 20% of total 2025 holiday e-commerce spending. AI isn't just nibbling at the edges—it's rewriting the entire game.

How Consumers Actually Use AI for Christmas Shopping

The mechanics of AI shopping reveal which companies capture value—and which just provide free marketing for competitors.

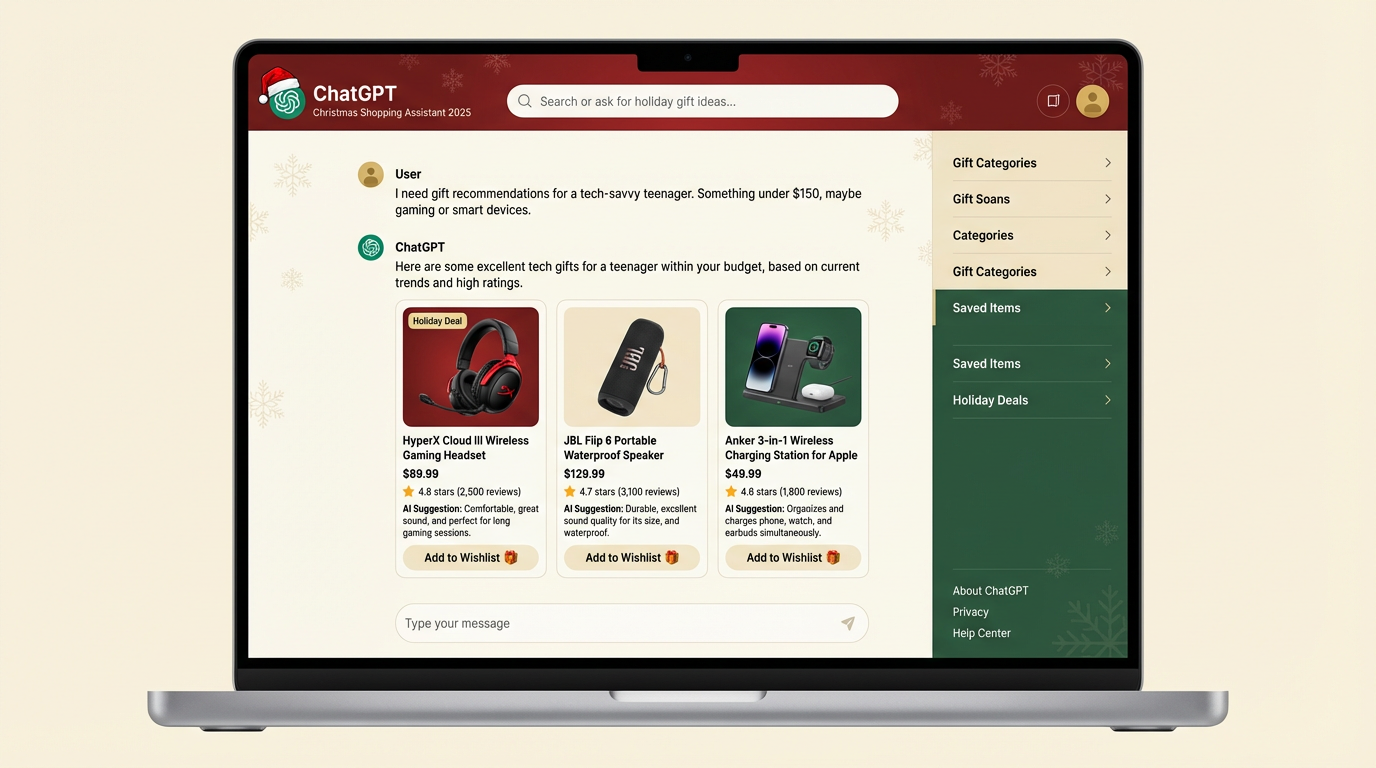

1. ChatGPT's Shopping Research: The New Gift Consultant

OpenAI launched dedicated shopping research features in November 2025, and adoption has been explosive.

What It Does:

- Generates personalized gift guides based on recipient characteristics ("tech-savvy teenager," "fitness enthusiast mom")

- Compares products across retailers with visual and text-based analysis

- Provides real-time price tracking, sales alerts, and discount codes

- Remembers context from prior conversations to refine suggestions

The Economics:

- 250 million shoppers have used ChatGPT for holiday shopping

- OpenAI's "Instant Checkout" program (co-developed with Stripe) enables direct purchases

- Early partners: Walmart, Target, Etsy, Shopify merchants (Glossier, Skims, Vuori, Spanx)

- OpenAI charges merchants a "small fee" per transaction—effectively creating a new revenue stream from referral commerce

Investor Insight: OpenAI isn't just a chatbot company anymore. With $263 billion in holiday sales up for grabs, even a 1-2% take rate on transactions could generate $2.6 billion to $5.2 billion annually—potentially offsetting a chunk of its $15 billion inference cost crisis.

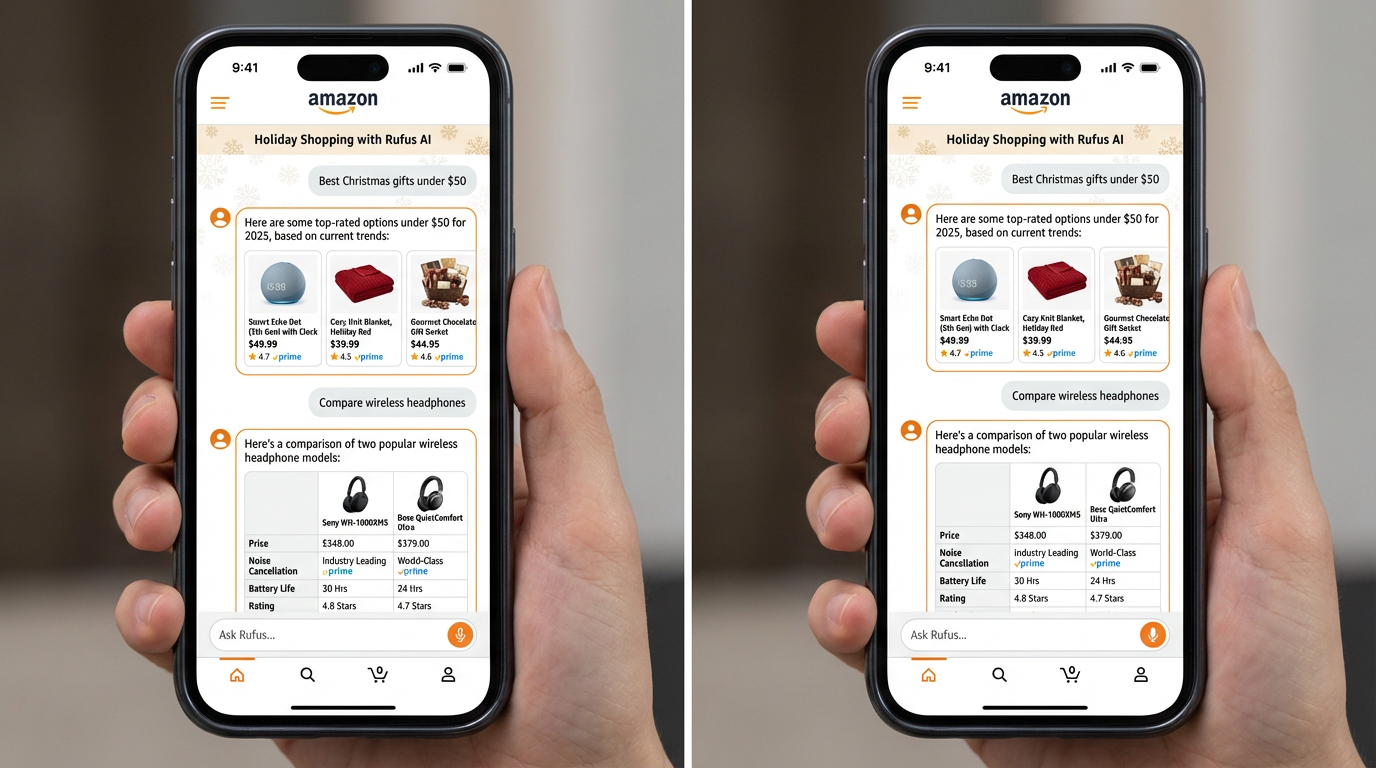

2. Amazon Rufus: The $10 Billion Shopping Assistant

Amazon's AI chatbot, Rufus, represents the retailer's most significant AI investment—and it's paying off.

Performance Metrics:

- 250 million active users (same as ChatGPT, but within Amazon's ecosystem)

- Users who engage with Rufus are 60% more likely to complete a purchase

- 100% surge in purchases on Black Friday 2025 for sessions involving Rufus

- $10 billion+ in annual incremental sales projected

What Makes It Different:

- Deep personalization: Rufus knows your purchase history, wish lists, and browsing behavior

- Automatic price tracking: 30- and 90-day price history with auto-buy at target prices (Prime members)

- 24/7 customer service: Handles returns, refunds, package tracking, and escalates to humans when needed

- "Buy For Me" feature: Purchases items from other retailers' sites within Amazon's app (launched April 2025)

The Walled Garden Strategy: Amazon actively blocks external AI chatbots (ChatGPT, Perplexity, Google) from crawling its site. In November 2025, Amazon filed a federal lawsuit against Perplexity AI for "unauthorized access." This creates a strategic moat—Amazon captures AI shopping value internally while denying competitors visibility into its product catalog.

Investor Insight: Amazon's AI infrastructure spending is accelerating (capex up significantly for 2025-2026), but Rufus demonstrates immediate ROI. $10 billion in incremental sales at even a conservative 5% operating margin generates $500 million in annual profit—justifying billions in AI capex.

3. Walmart, Target, and the Retailer Response

Traditional retailers are scrambling to compete, with mixed success.

Walmart:

- Sparky AI chatbot: Conversational shopping, party planning, product suggestions

- OpenAI partnership: Shopping directly within ChatGPT (announced October 2025)

- CEO Doug McMillon views "agentic AI" as a key e-commerce growth driver

Target:

- Target Gift Finder: AI-powered tool in its second holiday season

- ChatGPT integration: Multi-item purchases including groceries, delivery/pickup options

- 25% of customer searches are now descriptive/conversational (Chief Product Officer Prat Vemana)

Google:

- Gemini Shopping: Shoppable product listings, comparison tables, conversational search

- Agentic AI features: Calls stores to check inventory, autonomously tracks prices, makes purchases with user permission

- Agent Payments Protocol: Launched September 2025 to enable verifiable AI agent purchases

The SEO → AEO Shift: Traditional Search Engine Optimization (SEO)—relying on keywords and paid placements—is dying. AI platforms prioritize credible information, reviews, and detailed product descriptions over sponsored links.

Retailers are now investing in Answer Engine Optimization (AEO):

- PacSun: Reformatted website for AI discoverability, reallocated budgets from SEO to AEO

- Ethique Beauty: Overhauled search approach, leading to 90% increase in AI platform traffic

Investor Insight: Retailers spending billions on Google/Facebook ads are about to see diminishing returns. The winners will be those who pivot fastest to AEO—but this requires technical overhauls most legacy retailers aren't prepared for.

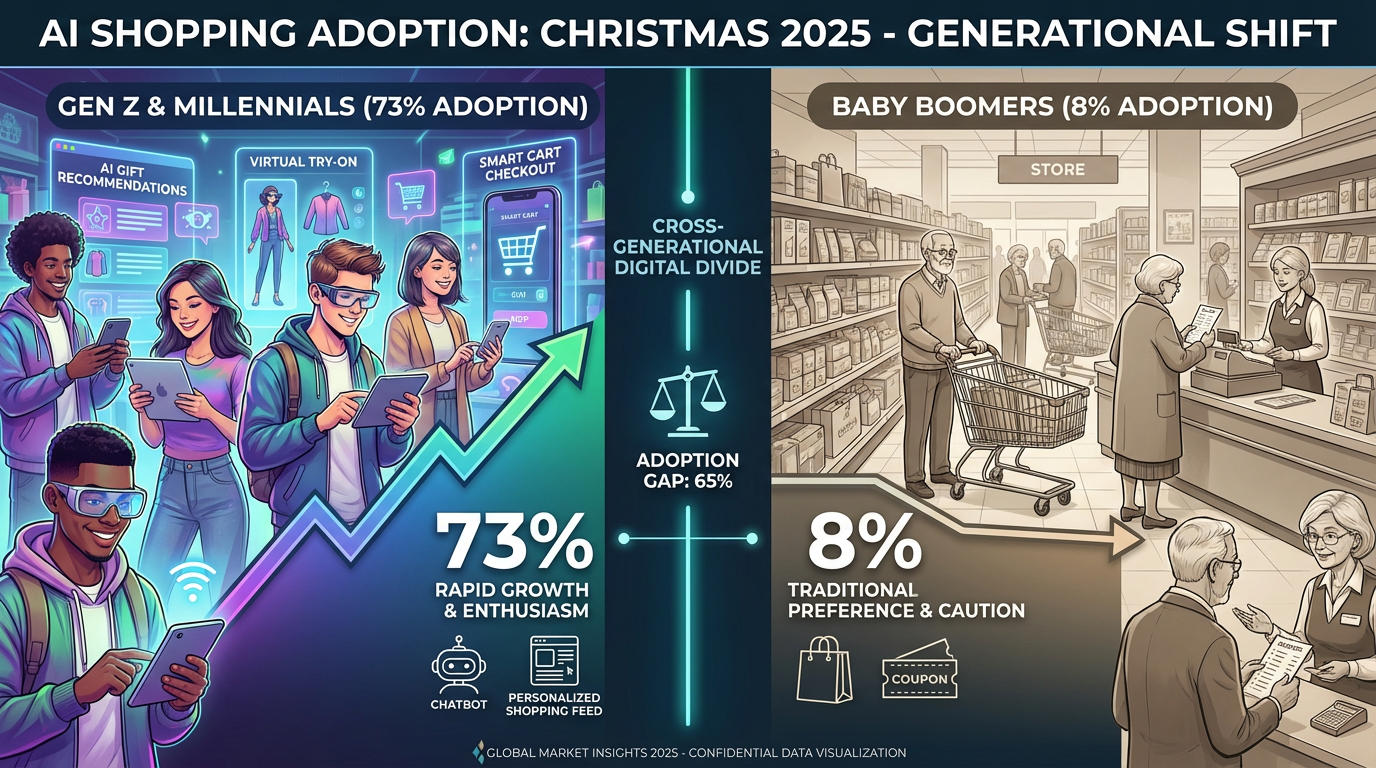

The Generational Divide: AI's Adoption Cliff

The most critical data point for long-term investors isn't the 75% headline adoption rate—it's the massive generational gap that reveals AI shopping's true trajectory.

The Age Breakdown

Gen Z (18-24):

- 73% will use AI for product discovery and purchases

- 61% have already used AI for shopping in the past year

- 43% use AI as often as search engines for gift ideas

- 50% plan to use AI for gift recommendations specifically

Millennials (25-40):

- 57% have used AI for purchases in the past year

- High engagement with conversational AI shopping tools

- 76% likely to use AI for travel/event planning

Gen X (41-56):

- 15% adoption for AI shopping tools

- 12% use AI for gift planning

Baby Boomers (57+):

- 8% adoption for AI shopping

- 85% have never used AI for gift selection

- 80% will not rely on AI for festive shopping

- Over 50% never use AI tools at all

What This Means for Investors

The generational cliff is both an opportunity and a warning:

Bull Case: Gen Z and Millennials represent $4.5 trillion in annual spending power (and growing). As they age into peak earning years, AI shopping could capture an ever-larger share of total retail.

Bear Case: 41% of Americans absolutely would not use AI for gift selection (SurveyMonkey). If older demographics never adopt AI shopping, the addressable market caps out at ~60% of consumers—still massive, but not the "everyone will use AI" story bulls are betting on.

The 10-Year View:

- 2025-2030: AI shopping grows from 40-75% adoption to 80%+ among Gen Z/Millennials, driving explosive revenue for OpenAI, Amazon, Google

- 2030-2035: Gen X adoption remains sub-30%, but their declining spending power makes them less critical

- 2035+: Baby Boomer spending power wanes; AI shopping becomes the default for younger cohorts

Investment Implication: AI shopping isn't a fad—it's a demographic inevitability. But the path to ubiquity is a 10-15 year timeline, not 2-3 years. Investors need patience, not FOMO.

Trust, Privacy, and the AI Shopping Paradox

Despite explosive adoption, consumer trust remains fragile—and this creates both risks and opportunities.

The Trust Gap

- 71% of consumers support AI-assisted shopping (Capgemini)

- 58% prefer AI over traditional search engines for recommendations (up from 25% in 2023)

- But only 45% trust AI assistance (CMSwire)

- 38% are satisfied with AI chatbot customer service

Top Consumer Concerns

- Accuracy: 41% worry AI will select the wrong item

- Fraud: 46% fear security risks

- Privacy: 49% concerned about data handling

- "AI Hallucinations": Doubts about reliability of AI recommendations

- Transparency: 84% want to know when AI is being used; only 50% of retailers disclose it

The Retailer Trust Problem

- 92% of retailers claim to use AI responsibly (Talkdesk)

- But only 50% inform customers when AI is active

- 60% of consumers want stricter oversight and standards

- 61% still prefer human interaction for customer service

The Paradox: Consumers use AI shopping tools at record rates while simultaneously not trusting them. This suggests two scenarios:

- "Good Enough" AI: Shoppers use AI for convenience despite trust concerns, similar to early Amazon reviews or Uber rides

- Fragile Foundation: If AI shopping experiences fail (wrong gifts, privacy breaches, price gouging), adoption could collapse faster than it grew

Investor Insight: Companies that prioritize transparency, accuracy, and user control (Amazon's price history, Google's comparison tables) will capture long-term value. Those chasing short-term engagement metrics risk regulatory backlash and user exodus.

Who Wins the $263 Billion AI Christmas War?

The investment landscape is complex, with clear winners and surprising losers.

Tier 1 Winners: The Infrastructure Players

1. Amazon (AMZN)

- Direct monetization: $10B+ in incremental Rufus-driven sales

- Ecosystem moat: Walled garden strategy prevents competitors from accessing product data

- AI capex paying off: Rufus demonstrates immediate ROI on infrastructure spending

- Target Price Catalyst: If Rufus drives $20B+ in annual sales by 2026, Amazon's retail operating income could increase $1-2 billion—justifying current AI capex

2. OpenAI/Microsoft (MSFT)

- Referral commerce: 1-2% take rate on $263B = $2.6-5.2B annually

- Strategic partnerships: Walmart, Target, Etsy, Shopify integrate ChatGPT Shopping

- Microsoft exposure: 49% stake in OpenAI means MSFT captures AI shopping upside

- Risk: Amazon's walled garden limits ChatGPT's product catalog visibility

3. Google (GOOGL)

- Search disruption defense: Gemini Shopping protects against ChatGPT encroachment

- Agentic AI leadership: Agent Payments Protocol positions Google for autonomous shopping future

- Ad revenue hedge: Even if search declines, Google captures value via AI shopping referrals

- Challenge: Must monetize AI shopping without cannibalizing existing search ad revenue

4. Stripe

- Agentic Commerce Protocol: Co-developed with OpenAI, powers Instant Checkout

- Payment infrastructure: Processes transactions for ChatGPT, Walmart, Target partnerships

- High-frequency AI transactions: New revenue stream as AI agents make autonomous purchases

- Target Valuation: If AI shopping scales to $500B+ annually, Stripe could process $50-100B (10-20%)—adding billions in transaction fees

Tier 2 Winners: The Retail Adapters

Walmart (WMT) and Target (TGT)

- Defensive necessity: Must integrate AI to avoid Amazon's dominance

- ChatGPT partnerships: Extend reach beyond their own apps

- Challenge: Heavy investment required with uncertain ROI; Amazon's lead may be insurmountable

Shopify (SHOP)

- Platform play: Enables merchants to integrate ChatGPT Shopping via Instant Checkout

- Scale advantage: 4.5M+ merchants benefit from OpenAI's traffic

- Risk: If Amazon/Walmart dominate AI shopping, Shopify merchants lose discoverability

The Losers: Traditional Digital Marketing

Meta (META) and Google Ads

- SEO → AEO shift: Billions in paid search/social ads become less effective

- AI platforms ignore ads: ChatGPT, Rufus prioritize organic results over paid placements

- Brand ad pivot: Advertising experts predict shift from direct response to brand advertising (influencing AI agents' recommendations)

- Revenue risk: If 20% of holiday shopping ($263B) moves to AI platforms, Meta/Google could lose $5-10B annually in ad spend

Investment Implication: The AI shopping war isn't zero-sum. Amazon and OpenAI can both win—but traditional digital ad platforms are the clear losers. Expect margin compression for Meta's ad business and slower growth for Google Ads through 2026.

The 2026-2030 Outlook: AI Agents and Autonomous Shopping

The current wave of AI shopping tools—ChatGPT, Rufus, Gemini—represent Generation 1. The next phase will be truly autonomous AI agents.

What's Coming Next

Autonomous AI Agents Will:

- Negotiate deals across multiple retailers

- Track prices 24/7 and auto-buy when targets hit

- Handle returns/exchanges without human intervention

- Predict needs (e.g., order diapers before you run out)

- Organize delivery and coordinate gift-giving across family members

Infrastructure Requirements:

- Model Context Protocol (MCP): Enables AI agents to understand complex multi-step tasks

- Agent-to-Agent Protocol: Allows AI shopping agents to communicate with retailer AI systems

- Agent Payments Protocol: Secure, verifiable transactions initiated by AI (Google/Stripe)

- Delegated authorization: Programmable spend policies, consent attestation

Market Projections:

- McKinsey: $900B-1T in U.S. B2C retail by 2030 orchestrated by AI agents

- $3T-5T globally by 2030

- Current AI shopping tools (2025) are 0.1% of this vision

The Trust Bottleneck

For autonomous AI shopping to scale, three things must happen:

- Regulatory Clarity: Clear rules on AI agent purchases, liability, consumer protection

- Payment Infrastructure: Visa/Mastercard developing "AI-ready cards" with spend limits, category restrictions

- Consumer Confidence: People must trust AI agents won't drain bank accounts or make unauthorized purchases

Bull Case: AI agent shopping reaches 30-50% adoption by 2030, driven by younger demographics and proven reliability. OpenAI, Amazon, Google capture $50-100B in annual transaction fees.

Bear Case: Privacy breaches, fraud, or "AI agent gone rogue" incidents create regulatory crackdown and consumer backlash. Adoption stalls at 10-15%, limiting upside.

Investor Insight: The 2025 AI Christmas boom is the proof of concept. The 2026-2030 period determines whether AI shopping becomes a trillion-dollar market or a niche tool for tech-savvy shoppers. Position for the bull case, but hedge for the bear.

Investment Playbook: How to Profit from AI Christmas Shopping

Based on the data, here's the actionable strategy:

For Aggressive Investors (High Risk/Reward)

Buy:

- Amazon (AMZN): Direct AI shopping monetization, walled garden moat

- Microsoft (MSFT): OpenAI exposure via 49% stake, Azure AI infrastructure

- Shopify (SHOP): Platform play on ChatGPT Shopping, 4.5M merchant reach

Thesis: AI shopping scales to $500B+ annually by 2027; these companies capture 20-30% of transaction value.

Risk: Regulatory crackdown, consumer trust collapse, or Google/Meta competitive response.

For Moderate Investors (Balanced Approach)

Buy:

- Amazon (AMZN): Proven Rufus ROI, defensive moat

- Google (GOOGL): Hedges search disruption risk with Gemini Shopping

- Visa/Mastercard: Payment infrastructure for AI agent transactions

Thesis: AI shopping becomes mainstream (60-70% adoption by 2028); payment processors and established retailers capture steady, predictable growth.

Risk: Slower adoption than expected; traditional retail resilience.

For Conservative Investors (Capital Preservation)

Underweight:

- Meta (META): Ad revenue at risk from SEO → AEO shift

- Traditional Retailers (TGT, WMT): Heavy AI capex with uncertain ROI; Amazon's lead may be insurmountable

Thesis: AI shopping disrupts traditional digital marketing and erodes retail margins. Avoid companies without clear AI shopping strategies.

The Bottom Line: AI's Christmas Takeover Is Real—But Not for Everyone

The data is undeniable: 75% of holiday shoppers are using AI, driving $263 billion in Christmas sales and forcing a fundamental restructuring of retail economics. Amazon's Rufus generates $10 billion in incremental revenue, ChatGPT attracts 250 million shopping users, and the shift from SEO to AEO is creating billion-dollar winners and losers.

But the generational divide reveals the truth: AI shopping is inevitable for Gen Z and Millennials (73% adoption), marginal for Gen X (15%), and non-existent for Baby Boomers (8%). This isn't a universal revolution—it's a demographic wave that will take 10-15 years to fully play out.

For investors, the message is clear:

- Position for the long term: AI shopping isn't a 2-year trade; it's a 10-15 year structural shift

- Bet on infrastructure: Amazon, Microsoft/OpenAI, Google, Stripe capture transaction value; retailers face margin compression

- Hedge digital ads: Meta and Google Ads lose billions as SEO → AEO accelerates

- Watch for trust breaks: Privacy breaches or fraud incidents could derail adoption faster than expected

The AI Christmas takeover is real. But like every technological revolution, the winners aren't always obvious, and the timeline is longer than bulls expect.

The companies that win won't be the ones with the flashiest AI demos. They'll be the ones that earn consumer trust, navigate regulatory uncertainty, and build sustainable economics around AI shopping—not just hype.

And for the 85% of Baby Boomers who refuse to let ChatGPT pick their grandkids' gifts? They'll keep shopping the old-fashioned way—proving that even in the age of AI, some things are too personal to automate.

Sources & References

- 1. [Adobe, "2025 Holiday Shopping Report," November 2025]

- 2. [CNBC, "AI tools could drive $263 billion in holiday sales," December 12, 2025]

- 3. [PayPal, "2025 Holiday Shopping Survey," October 2025]

- 4. [Talkdesk, "AI Holiday Shopping Trends 2025," November 2025]

- 5. [Digital Commerce 360, "ChatGPT adds shopping research," November 25, 2025]

- 6. [Fortune, "Amazon Rufus AI shopping assistant," November 2, 2025]

- 7. [Deloitte, "2025 Holiday Retail Survey," November 2025]

- 8. [Bread Financial, "Holiday 2025: ChatGPT enters the conversation," November 3, 2025]

- 9. [The Guardian, "Is retail ready for AI shaking up how we shop?" December 10, 2025]

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher