Why Small Focused AI Startups Make Money While Big Tech Hemorrhages Billions

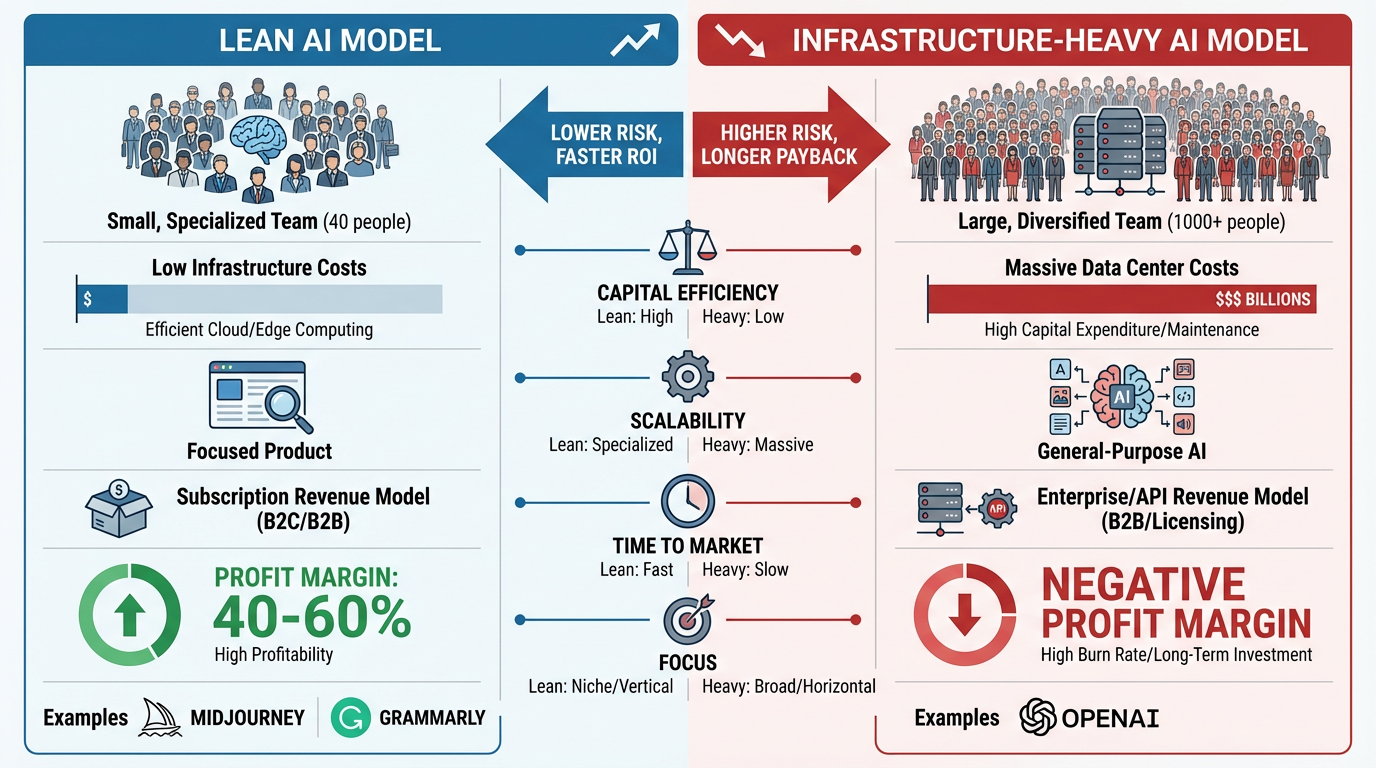

As Big Tech hemorrhages billions on AI infrastructure, a quiet revolution is unfolding: Small, focused AI startups like Midjourney ($500M revenue), Grammarly ($700M ARR), and Harvey AI ($100M ARR) are printing money—proving that the companies spending the least are making the most.

As Big Tech hemorrhages billions on AI infrastructure, a quiet revolution is unfolding: Small, focused AI startups are printing money—and rewriting the rules of the AI economy

By Taggart Buie

December 18, 2025

Here's the most counterintuitive fact in tech right now: While OpenAI burns through $15 billion annually chasing AGI, a 107-person company called Midjourney is projected to hit $500 million in revenue in 2025—and they've done it without a single dollar of venture capital.

While Microsoft, Google, and Amazon collectively pour $400 billion into AI infrastructure that won't break even for years, a legal AI startup called Harvey just crossed $100 million in annual recurring revenue with 500 employees and charges law firms $1,200 per lawyer per month.

And while the AI industry as a whole faces an $340 billion profitability gap (spending $400B, generating $60B in revenue), companies like Grammarly ($700M+ ARR), Perplexity ($200M ARR), and Otter.ai ($100M ARR) are building sustainable, profitable businesses—often with teams smaller than a Google cafeteria staff.

Welcome to the AI Profitability Paradox: The companies spending the least are making the most.

The Profitability Crisis: A Quick Recap

Before we dive into the winners, let's establish just how bad the losses are at the top:

The Billion-Dollar Losers:

- OpenAI: -$15 billion projected loss (2025), with $8.65B in inference costs alone

- CoreWeave: $20B spending vs. $5B revenue, carrying $14B in debt (1/3 due next year)

- Anthropic (Claude): Estimated -$2.7B loss (2025)

- Industry Total: $340 billion annual burn across the AI sector

The Infrastructure Trap:

- Average 100MW data center cost: $1.2-$1.5 billion (U.S.)

- Nvidia H100 cluster (8,000 GPUs): $240 million

- Energy costs scaling faster than Moore's Law

- Profitability horizon: 2029+ for most

Now, let's meet the companies that figured out how to win without bleeding billions.

The Quiet Winners: Small AI Companies Making Real Money

1. Midjourney: The $500M Self-Funded Unicorn

The Numbers:

- 2025 Revenue (Projected): $500 million

- Team Size: 107 employees

- Revenue Per Employee: $4.7 million

- Funding Raised: $0 (completely self-funded)

- Profitability: Achieved within 6 months of launch

The Model: Midjourney didn't try to build the next GPT. They focused on one thing: generating stunning images from text prompts. Their subscription tiers are simple:

- Basic: $10/month (3.3 hours GPU time)

- Standard: $30/month (15 hours GPU time)

- Pro: $60/month (30 hours GPU time)

- Mega: $120/month (60 hours GPU time)

By March 2023, they eliminated free trials entirely—forcing users to pay from day one. The result? 26.8% market share in generative AI imaging, ahead of DALL-E (24.4%) and a user base exceeding 25 million.

What Makes Them Different:

- No VC funding = No pressure for hypergrowth at any cost

- Focused product = Lower R&D costs than general-purpose AI

- Community-driven growth = Near-zero customer acquisition costs

- Proprietary ASR engine = Not paying OpenAI/Anthropic for API access

Midjourney's founder, David Holz, summed it up perfectly: "We're not trying to boil the ocean. We're solving one problem exceptionally well."

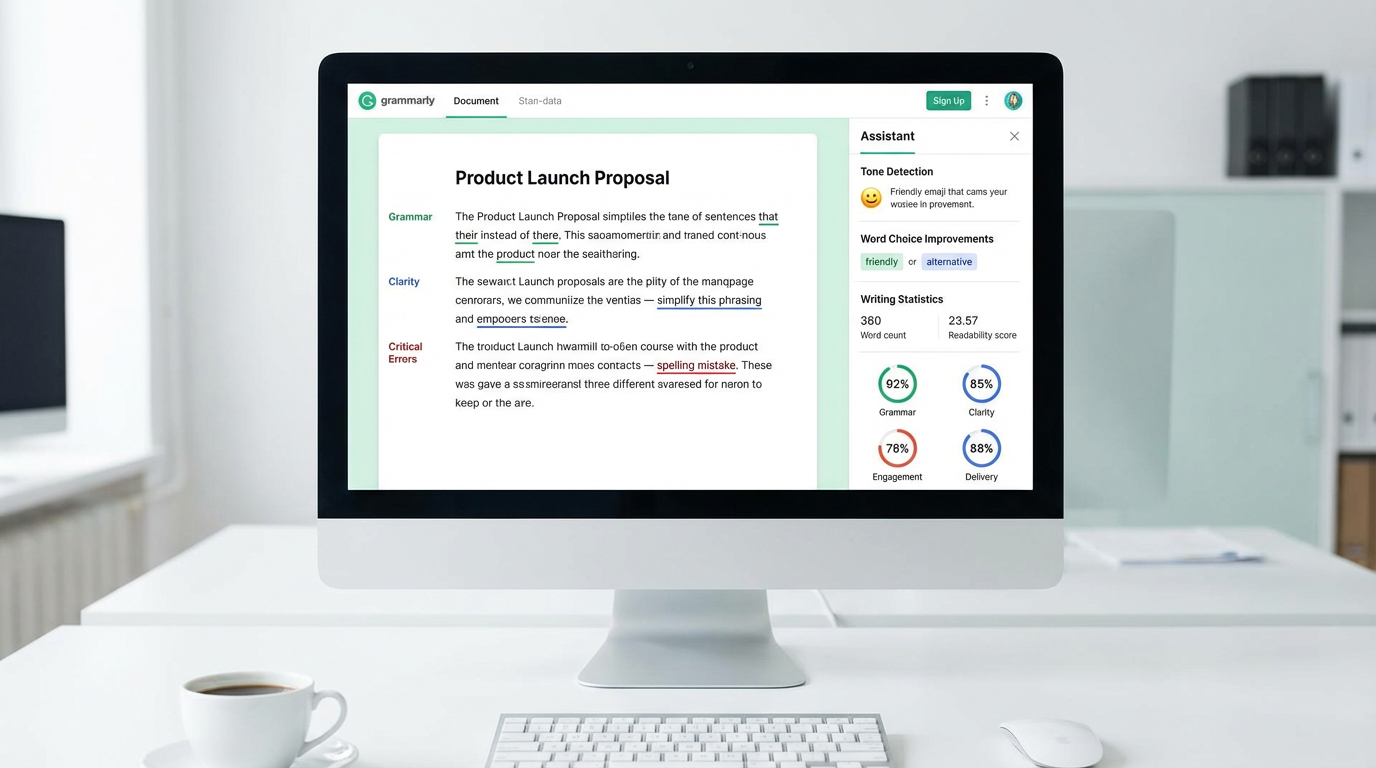

2. Grammarly: The $700M+ Writing Assistant Giant

The Numbers:

- 2025 Revenue: $700 million+ in ARR

- Users: Over 40 million daily (70,000+ organizations)

- Team: Approximately 800 employees

- Gross Margins: ~80% (even with LLM costs)

- Latest Funding: $1 billion non-dilutive growth financing (May 2025)

The Model: Grammarly started as a grammar checker in 2009, but by 2025, it had evolved into a full AI productivity platform. Their revenue comes from:

- Consumer Subscriptions: Free tier → Premium ($12/month) → Business ($15/user/month)

- Enterprise Licenses: Custom pricing for Fortune 500 companies

- AI Add-ons: GrammarlyGO features (generative writing assistance)

What Makes Them Different:

- 14-year head start: Built trust before AI hype

- Network effects: Every correction trains the model

- Sticky integration: Embedded in Gmail, Slack, Microsoft Office

- Non-native English speakers: Massive TAM (India, Philippines driving growth)

The acquisition of productivity startup Coda in January 2025 signals Grammarly's ambition to become the AI productivity OS—competing with Microsoft 365, not just Hemingway Editor.

3. Harvey AI: The $100M Legal Tech Disruptor

The Numbers:

- 2025 Revenue: $100 million ARR (August 2025), projected $150M by year-end

- Valuation: $8 billion (December 2025 funding)

- Customers: Over 500 (including 50+ AmLaw 100 firms)

- Pricing: ~$1,200 per lawyer per month

- Growth: 4x weekly users year-over-year

The Model: Harvey is AI for lawyers—legal research, contract drafting, due diligence. They charge law firms premium rates because they save millions in associate hours:

- Macfarlanes (UK): Expanded from 70 users to 950 licenses

- Honigman: Increased from 10% to 35% of attorneys using Harvey

- Enterprise Clients: Comcast, Walmart, KKR, PwC, Bayer, Deutsche Telekom

What Makes Them Different:

- Vertical focus: Built specifically for legal workflows, not generic chatbots

- Premium pricing: $1,200/month/lawyer vs. $20/month for ChatGPT Plus

- Enterprise sales: Land-and-expand strategy (start with 100 seats, grow to 1,000+)

- ROI clarity: Law firms can measure savings in billable hours

Founder Winston Weinberg's insight: "We're not selling AI. We're selling time back to lawyers—and that's worth $1,200/month."

4. Perplexity AI: The $200M Search Challenger

The Numbers:

- 2025 Revenue: ~$200 million ARR (approaching, as of September 2025)

- Valuation: $20 billion (September 2025 funding)

- Users: 45 million active users (66% YoY growth)

- Queries: 780 million per month (May 2025, up from 230M in August 2024)

- Pricing: $20/month for Perplexity Pro (unlimited queries, GPT-4 access)

The Model: Perplexity is reimagining search with AI-generated answers instead of link lists. Revenue comes from:

- Perplexity Pro subscriptions: $20/month

- Enterprise deals: Zoom, Nvidia using Perplexity as their search engine

- Contextual ads: Launched mid-2025

- In-line commerce: Buy products directly from search results

What Makes Them Different:

- Search reimagined: Not trying to out-Google Google—different product entirely

- Data flywheel: 780M queries/month = massive training data advantage

- Strategic partnerships: Motorola (device integration), Telkomsel (Pro bundling)

- Mozilla Firefox: Default search option globally on desktop

CEO Aravind Srinivas's vision: "Google shows you 10 blue links. We give you the answer."

5. Otter.ai: The $100M Meeting Transcription King

The Numbers:

- 2025 Revenue: $100 million ARR (March 2025)

- Users: Over 25 million

- Team: Less than 200 employees

- Revenue Per Employee: $500,000+

- Gross Margins: 70-80%

The Model: Otter.ai transcribes meetings in real-time and is evolving into a meeting knowledge base. Pricing tiers:

- Free: Limited minutes

- Pro: $10/month (1,200 minutes)

- Business: $20/month (6,000 minutes)

- Enterprise: Custom pricing with API access

The Viral Trick: Every time an Otter bot joins a Zoom call, it generates 7.5 new social interactions (participants see the bot, get curious, sign up). This "bot-in-meeting effect" drives customer acquisition cost down to $0.32 per user.

What Makes Them Different:

- Sales teams love it: 68% of AI notetaker revenue comes from sales orgs (31% of users)

- Enterprise expansion: October 2025 launch of API and MCP server

- HIPAA compliance: July 2025—opening healthcare vertical

- Workflow automation: Evolving from transcription to action items, CRM updates, Jira tickets

Founder Sam Liang: "We're not a note-taking app. We're corporate memory."

6. Runway ML: The $300M Video AI Innovator

The Numbers:

- 2025 Revenue: $300 million (projected, per CEO Cristóbal Valenzuela)

- Valuation: $3 billion (April 2025)

- Users: 300,000 customers

- Growth: 146.67% YoY (2024-2025)

The Model: Runway ML generates AI videos from text and images. It's used by Hollywood studios, advertising agencies, and indie creators. Products include:

- Gen-3 Alpha: Ultra-fast, high-quality video generation

- Act One: Expressive character animations

- API: Developers can embed Runway's video models in their apps

What Makes Them Different:

- Creative tooling focus: Not competing with OpenAI's general-purpose models

- Hollywood partnerships: Used in actual film production

- API strategy: Licensing models to other companies

- Subscription + usage: Predictable revenue + variable upside

Runway is proving that vertical AI in creative tools can scale to hundreds of millions in revenue without the infrastructure burden of training frontier models.

The Other Quiet Winners

These companies didn't make the top 6, but they're building real businesses:

Jasper AI (Marketing Copy)

- $88 million revenue (2025 projection)

- 480% revenue growth in 2024

- 850+ enterprise customers

Descript (Audio/Video Editing)

- $55 million ARR (late 2024, 75% YoY growth)

- 80% gross margins even with LLM costs

- B2B focus: marketing teams, sales enablement

Copy.ai (Go-to-Market AI)

- Acquired by Fullcast (October 2025)

- 480% revenue growth in 2024

- 16 million+ users

The Formula: What Small AI Winners Do Differently

After analyzing these success stories, five patterns emerge:

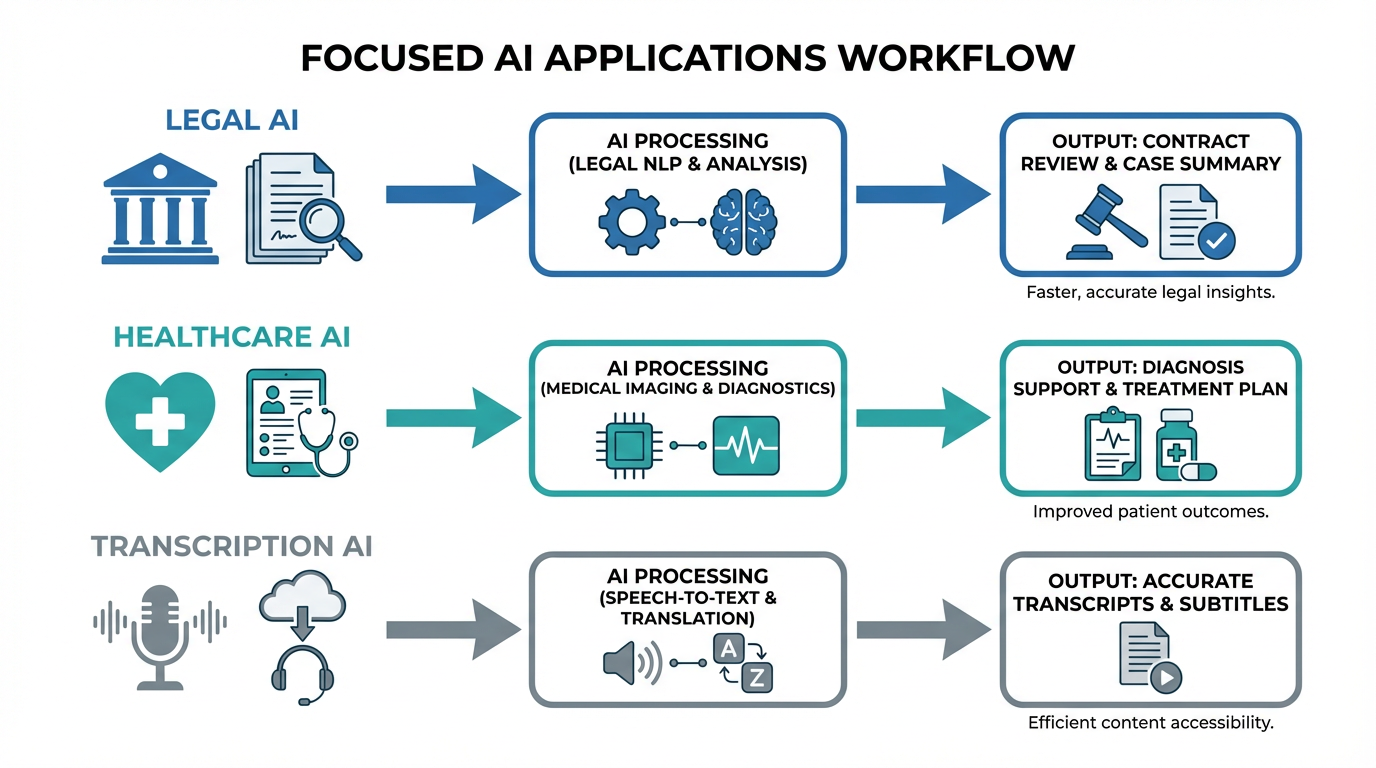

1. Niche Focus Over General-Purpose AGI

Winners:

- Midjourney: Image generation

- Harvey: Legal AI

- Otter.ai: Meeting transcription

- Grammarly: Writing assistance

Losers:

- OpenAI: Trying to build AGI (everything for everyone)

- Anthropic: Trying to build "constitutional AI" (everything, but safely)

The math is simple: Focusing on one problem lets you:

- Train smaller, specialized models (cheaper inference)

- Achieve product-market fit faster (clearer use case)

- Charge premium prices (ROI is obvious)

2. Freemium → Premium, Not Free Forever

All the winners converted from freemium to paid:

- Midjourney: Eliminated free trials in March 2023

- Grammarly: Free tier designed to convert (limited features)

- Perplexity: Free tier = 5 searches/day, Pro = unlimited

- Otter.ai: Free tier = limited minutes, forces upgrade

Meanwhile, ChatGPT remains free for billions of users—subsidizing consumer adoption while corporate revenue lags.

3. B2B Pricing Power Beats B2C Volume

B2B Winners:

- Harvey AI: $1,200/month per lawyer

- Grammarly Business: $15/user/month (70,000 orgs)

- Otter.ai Enterprise: $600/year per seat average

B2C Struggles:

- ChatGPT Plus: $20/month (individual users)

- Midjourney: $10-$120/month (prosumers)

The lesson: Enterprise customers pay 10-60x more than consumers—and they stick around longer.

4. Low Inference Costs = High Margins

The winners don't run massive frontier models:

- Midjourney: Proprietary image models (fraction of LLM costs)

- Grammarly: Fine-tuned models for grammar (80% gross margins)

- Otter.ai: Speech-to-text + lightweight summarization (70-80% margins)

- Harvey: Uses third-party LLMs but charges 60x more than the API costs

Meanwhile:

- OpenAI: $0.70-$2.50 per query for GPT-4 (loses money at $20/month)

- Anthropic: Similar economics—inference costs exceed subscription revenue

5. Lean Teams, Fat Margins

Revenue Per Employee:

- Midjourney: $4.7 million (107 employees, $500M revenue)

- Otter.ai: $500,000+ (<200 employees, $100M ARR)

- Harvey: $200,000 (500 employees, $100M ARR)

Compare to:

- OpenAI: ~$7.3 million (1,500 employees, $11B revenue)—but -$15B in losses

- Anthropic: ~$2.7 million (1,000 employees, $2.7B revenue)—but -$2.7B in losses

High revenue per employee only matters if you're profitable. Midjourney wins not because they make $4.7M per employee, but because they keep most of it.

The Investment Implications: Where to Find the Next Midjourney

For investors watching the AI space, the profitability paradox creates a clear playbook:

🟢 Green Flags: What to Look For

1. Vertical Focus

- Look for "AI for [specific industry]" companies

- Examples: Harvey (legal), Tempus (healthcare), Vic.ai (accounting)

- Why it works: Specialized solutions command premium prices

2. Subscription Revenue with Usage-Based Upsells

- Base subscription ensures predictable cash flow

- Usage fees (credits, API calls) capture power users

- Examples: Descript ($144/year + AI credits), Otter.ai ($20/month + enterprise API)

3. Gross Margins >70%

- Indicates low inference costs relative to pricing

- Grammarly: 80% gross margins

- Otter.ai: 70-80% gross margins

- If margins are <50%, they're likely subsidizing growth (not sustainable)

4. Revenue Per Employee >$300K

- Signals operational efficiency

- Midjourney: $4.7M per employee

- Otter.ai: $500K+ per employee

- Avoid companies with <$200K (bloated teams, inefficient)

5. Path to Profitability Visible Within 2 Years

- Midjourney: Profitable in 6 months

- Perplexity: Targeting profitability by 2026

- OpenAI: Targeting profitability by 2029 (not a good sign)

🔴 Red Flags: What to Avoid

1. "We're Building AGI"

- Translation: "We have no clear business model and need billions to find out"

- Examples: OpenAI ($15B loss), Anthropic ($2.7B loss)

2. Massive Data Center CapEx

- If a startup is buying thousands of GPUs, run

- CoreWeave: $20B spending, $14B debt, $5B revenue

- Only hyperscalers (Google, Microsoft, AWS) can afford this model

3. Free Product with No Clear Monetization

- Character.AI: Millions of users, zero revenue for years (sold to Google for $2.7B—an acquihire, not a success)

- Replika: Popular but struggling to monetize emotional AI chatbots

4. B2C Only with <$20/Month Pricing

- Math doesn't work: LLM inference costs eat all margin at that price point

- ChatGPT Plus ($20/month) is loss leader for enterprise sales

5. "We're a Platform Play"

- Translation: "We don't know what we're building, so we'll let others figure it out"

- Platform economics only work at massive scale (AWS, Azure, GCP)

- Startups claiming "platform" usually have no product-market fit

Portfolio Construction: The Profitability-Focused AI Playbook

For Aggressive Investors (High Risk Tolerance)

Allocate 15-20% of tech portfolio to profitable/near-profitable AI:

- 40%: Vertical AI leaders (Harvey, Tempus, Rad AI) via secondary markets/VC funds

- 30%: Proven small winners (Midjourney, Grammarly, Perplexity) if accessible

- 20%: Early-stage vertical AI startups (seed/Series A with clear path to profitability)

- 10%: Public market plays (SoundHound AI—only public small AI with growth + profitability path)

Risk Management:

- Avoid any company targeting profitability beyond 2027

- Set 40% stop-loss on unprofitable positions

- Rebalance quarterly based on revenue growth + margin trends

For Moderate Investors

Allocate 8-12% of tech portfolio:

- 50%: Late-stage vertical AI (Series B+) with >$50M ARR and clear path to profitability

- 30%: Public market indirect plays (Nvidia, Microsoft, Google—they win regardless)

- 20%: AI infrastructure plays (CoreWeave debt is risky, but data center REITs benefit)

Risk Management:

- Focus on companies with gross margins >60%

- Avoid direct exposure to foundation model companies (too capital-intensive)

- Monitor enterprise adoption rates as leading indicator

For Conservative Investors

Allocate 3-5% of tech portfolio:

- 70%: Public hyperscalers (Microsoft, Google, Amazon)—they're profitable today

- 20%: AI infrastructure picks-and-shovels (Nvidia, Broadcom, TSMC)

- 10%: Late-stage profitable AI (Grammarly-like companies if/when they IPO)

Risk Management:

- Stick to profitable companies only

- Avoid all startups burning >$100M/year

- Treat as "emerging AI" allocation, not core holdings

The Reality Check: Why This Model Doesn't Scale to AGI

Before we get too excited about the small AI winners, let's acknowledge the elephant in the room: These companies are NOT building AGI, and they can't.

Here's why:

1. Specialized Models Can't Generalize

Midjourney's image models can't write code. Harvey's legal AI can't diagnose diseases. Otter.ai can't drive cars. These are narrow AI solutions—incredibly effective at their specific task, but fundamentally limited.

If your thesis is "AI will replace all human labor," you need general-purpose models. And those require the infrastructure spending that could possibly bankrupt OpenAI and Anthropic.

2. The Profitability-Capability Tradeoff

There's a direct tradeoff:

- Narrow AI (Midjourney, Harvey): Lower costs, higher margins, limited TAM

- General AI (OpenAI, Anthropic): Massive costs, negative margins, unlimited TAM (if it works)

OpenAI isn't burning $15B/year because they're stupid. They're burning it because training GPT-5 and beyond requires it. If they succeed in building AGI, that $15B becomes a rounding error. If they fail, they go bankrupt.

Midjourney's $500M profit is impressive—but they'll never build AGI with a 107-person team and no data center infrastructure.

3. The Market Will Eventually Commoditize Narrow AI

Consider transcription:

- Otter.ai today: $100M ARR, premium pricing

- Otter.ai in 2027: Competing with free transcription in Zoom, Teams, Google Meet

As foundation models improve, narrow AI tasks become features, not products. Microsoft Copilot will eventually absorb Grammarly's functionality. Google Meet will absorb Otter.ai's.

The winners are those who can either:

- Move up the stack (Grammarly's acquisition of Coda—becoming productivity OS)

- Lock in enterprise customers (Harvey's multi-year contracts with law firms)

- Build defensible data moats (Perplexity's 780M monthly queries)

4. The Venture Capital Pressure Cooker

Most of these "profitable" companies aren't actually keeping all that money:

- Harvey: Raised $800M, valued at $8B (investors expect 10x+ return)

- Perplexity: Raised $1.2B, valued at $20B (burning cash to compete with Google)

- Runway ML: Raised $544M, valued at $3B (R&D on video models is expensive)

Only Midjourney is truly independent. The rest will face pressure to either:

- IPO (liquidity event for investors)

- Get acquired (strategic exit)

- Scale aggressively (potentially sacrificing profitability)

VC-backed "profitability" often means "we can be profitable if we stop growing"—which VCs will never allow.

The Bottom Line: Two AI Economies Are Emerging

The AI industry is bifurcating into two distinct economies:

Economy #1: The AGI Race (Burn Billions, Maybe Win Everything)

Players: OpenAI, Anthropic, Google DeepMind, Meta AI

Model: Raise billions, build frontier models, pray for AGI breakthrough

Outcome: Winner-take-most (whoever achieves AGI first gets $10 trillion market cap) OR everyone goes bankrupt trying

For Investors: Pure speculation—bet on 1-2 players, accept total loss risk

Economy #2: The Profitable AI Niche (Make Money Today, Limited Upside)

Players: Midjourney, Harvey, Grammarly, Perplexity, Otter.ai, Jasper, Descript, Runway

Model: Focus on specific verticals, charge premium prices, achieve profitability quickly

Outcome: Build $500M-$5B businesses (great returns, not world-changing)

For Investors: Safer bets, predictable returns, limited to 10-50x (not 1,000x)

Investment Thesis: Where Smart Money Goes in 2026

If you're allocating capital to AI in 2026, here's the framework:

Scenario 1: You Believe AGI is 3-5 Years Away

- Bet on: OpenAI, Anthropic, Google (via Alphabet stock)

- Rationale: If AGI happens, these companies will capture 90% of the value

- Risk: They might burn out before crossing the finish line

- Allocation: 5-10% of portfolio (high-risk, high-reward)

Scenario 2: You Think AGI is 10+ Years Away (or Never Happens)

- Bet on: Vertical AI winners (Harvey, Tempus, Grammarly, etc.)

- Rationale: These companies are making money today, regardless of AGI timeline

- Risk: Market commoditization as foundation models improve

- Allocation: 10-15% of portfolio (medium-risk, solid returns)

Scenario 3: You're Agnostic on AGI Timeline

- Bet on: Infrastructure plays (Nvidia, Microsoft, AWS) + selective vertical AI

- Rationale: Nvidia wins whether AGI happens in 2027 or 2037

- Risk: Infrastructure oversupply if AI hype collapses

- Allocation: 15-20% of portfolio (diversified across AI value chain)

The Uncomfortable Truth: Profitability ≠ Building the Future

Here's the uncomfortable truth that every investor must confront:

Midjourney's $500M profit is more impressive than OpenAI's $15B loss—but OpenAI might still win the war.

Because if OpenAI achieves AGI:

- Midjourney's image generation becomes a free feature of GPT-5

- Harvey's legal AI becomes a free ChatGPT plugin

- Grammarly's writing assistance becomes obsolete

The profitability paradox isn't "small is better." It's "small is sustainable, big is speculative."

If you're building a business to cash flow in 2-3 years, do what Midjourney did: Focus on a niche, charge premium prices, stay lean.

If you're trying to build AGI, do what OpenAI does: Raise billions, burn billions, and accept that you'll either change the world, or could possibly go bankrupt.

There is no middle ground.

Conclusion: The AI Profitability Playbook for 2026

The AI industry's profitability crisis isn't a bug—it's a feature of the dual economy we've described.

For investors, the lesson is clear:

1. If you want safe, predictable returns: Back vertical AI companies with clear paths to profitability (Harvey, Tempus, Grammarly-types). Look for:

- Gross margins >70%

- Revenue per employee >$300K

- Path to profitability within 2 years

- B2B pricing power (>$100/month per user)

- Niche focus ("AI for X" not "AI for everything")

2. If you want moon-shot returns: Accept the risk of backing foundation model companies (OpenAI, Anthropic). Understand that:

- 90% of these companies will fail

- The 10% that succeed will return 100-1,000x

- You're betting on a technological breakthrough, not a business model

3. If you want to sleep at night: Buy Nvidia, Microsoft, or Google. They win in both scenarios:

- If AGI happens, they'll integrate it into existing products

- If AGI doesn't happen, they're still minting money from cloud and chips

The most important insight: The companies making money today (Midjourney, Harvey, Grammarly) are not in competition with the companies burning billions (OpenAI, Anthropic). They're playing different games entirely.

One game is about building sustainable, profitable businesses in narrow AI verticals.

The other is about racing to AGI before the money runs out.

Both can be right. Both can make investors wealthy. But only if you understand which game you're playing.

And if you're looking for the next Midjourney—a scrappy, self-funded startup turning $0 into $500M—start by asking: "What's a specific problem that AI can solve profitably today, not theoretically in 2030?"

Because in the AI profitability paradox, the winners aren't the ones spending the most.

They're the ones spending the least.

References

-

Sacra. "Midjourney revenue, funding & news." Sacra, 2025. https://sacra.com/c/midjourney/

-

GetLatka. "How Otter.ai hit $100M revenue with a 200 person team in 2025." GetLatka, 2025. https://getlatka.com/companies/otter.ai

-

CNBC. "Legal AI startup Harvey revenue." CNBC, August 4, 2025. https://www.cnbc.com/2025/08/04/legal-ai-startup-harvey-revenue.html

-

Sacra. "Grammarly revenue, funding & news." Sacra, 2025. https://sacra.com/c/grammarly/

-

Sacra. "Perplexity revenue, funding & news." Sacra, 2025. https://sacra.com/c/perplexity/

-

TechCrunch. "Runway, best known for its video-generating models, raises $308M." TechCrunch, April 3, 2025. https://techcrunch.com/2025/04/03/runway-best-known-for-its-video-generating-models-raises-308m/

-

Research Contrary. "Jasper: Revenue, Funding & Investors." Contrary Research, 2025. https://research.contrary.com/company/jasper

-

Sacra. "Copy.ai revenue, funding & news." Sacra, 2025. https://sacra.com/c/copyai/

-

Sacra. "Descript revenue, funding & news." Sacra, 2025. https://sacra.com/c/descript/

-

Forbes. "AI Startups That Focus Small Are Winning Big." Forbes, May 16, 2025. https://www.forbes.com/sites/kolawolesamueladebayo/2025/05/16/ai-startups-that-focus-small-are-winning-big/

-

ArticSledge. "AI Startup Ideas: Profitable AI Business Opportunities for 2025." ArticSledge, 2025. https://www.articsledge.com/post/ai-startup-ideas

-

ElectroIQ. "Midjourney Statistics: Revenue, Users, and Growth." ElectroIQ, 2025. https://electroiq.com/stats/midjourney-statistics/

This analysis is for informational purposes only and does not constitute investment advice. AI market dynamics evolve rapidly, and company financial positions can change significantly. Past performance does not guarantee future results. Readers should conduct their own research and consult with qualified financial advisors before making investment decisions.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher