The $0 AI Degree: How Free Training from Google, Microsoft, and AWS Is Disrupting the $2.5 Trillion Education Industry

Tech giants are giving away AI education that costs competitors $15,000—but only 5-15% finish. Free MOOCs from Google, Microsoft, AWS, and IBM attract millions, yet EdTech stocks crash 83% as universities fight back. Can you really learn AI for free, or is the $0 degree an expensive illusion?

The $0 AI Degree: How Free Training from Google, Microsoft, and AWS Is Disrupting the $2.5 Trillion Education Industry

Tech giants are giving away AI education that costs competitors $15,000. Here's the catch—and why investors should care.

December 26, 2025 — When Google announced its AI Essentials course in late 2024—completely free, requiring zero technical background, and offering a certificate in under 10 hours—traditional education executives had reason to panic. Not because Google was entering their market. But because Google, Microsoft, AWS, and IBM were collectively pouring billions into giving away what universities charge $50,000 to teach.

The numbers tell a startling story: while enrollment at traditional four-year computer science programs remains relatively flat, Andrew Ng's free Deep Learning Specialization on Coursera has attracted over 962,000 students. Fast.ai's Jeremy Howard reports alumni landing jobs at Google Brain, OpenAI, and Tesla—all from a free course. And Kaggle's micro-courses, each taking 1-7 hours, have become de facto prerequisites for data science interviews.

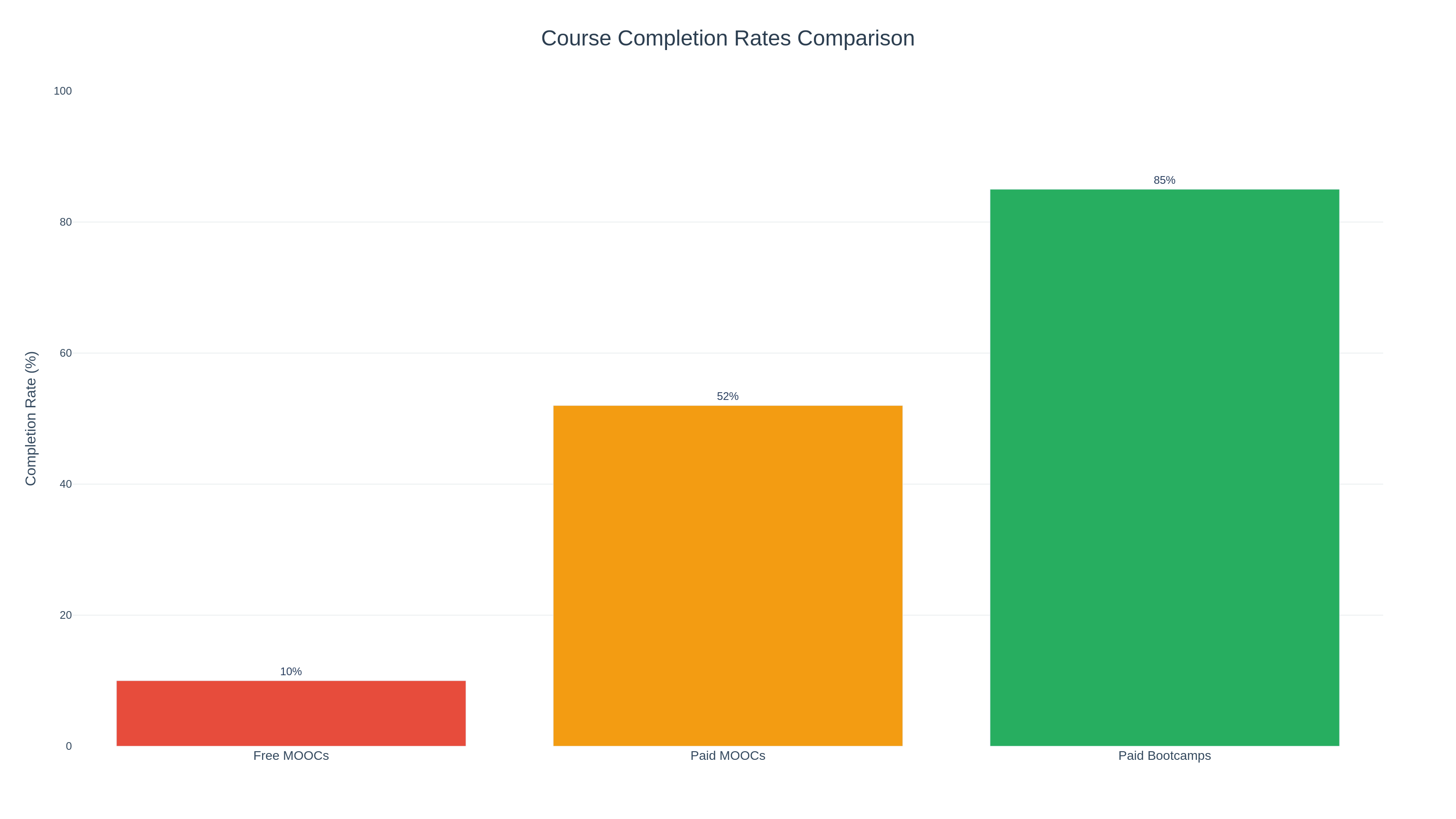

But here's where the narrative gets complicated: only 5-15% of students who start free AI courses actually finish them. Those who pay for certificates see completion rates jump to 44-60%. Traditional bootcamps, costing $3,500-$14,495, boast 80-90% completion rates. And when it comes to landing actual AI/ML engineering roles, the market remains brutally honest: Reddit threads are filled with skeptics claiming you need at least a Master's degree, no matter how many free courses you complete.

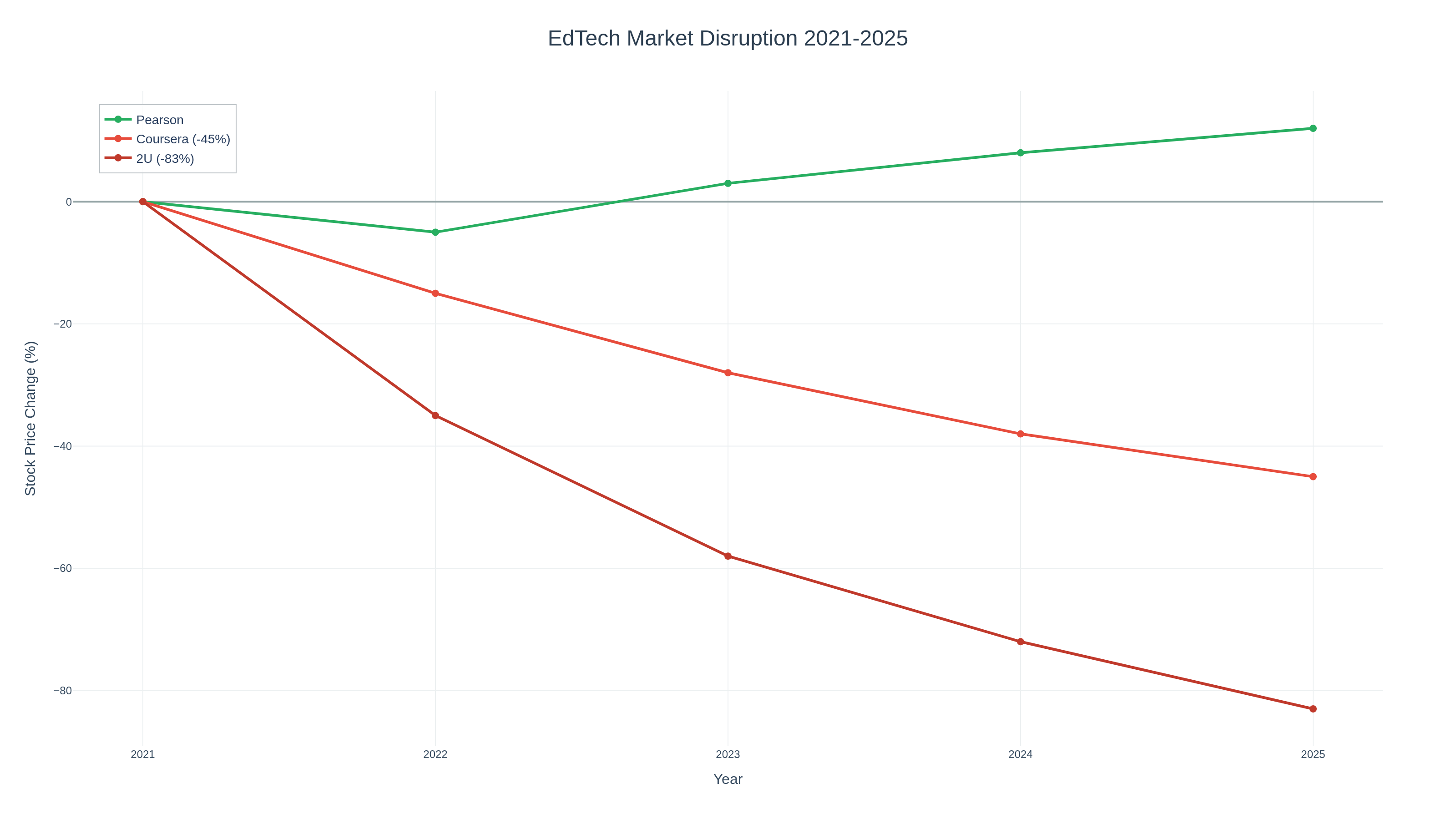

So what's the truth? Can you really become AI-competent for $0, or is free training just an expensive illusion? And for investors watching EdTech stocks crater—2U down 83%, Coursera down 45%—what does this disruption mean for the $2.5 trillion global education market?

Let's examine what tech giants are actually giving away, what they're not telling you, and why this matters to anyone with skin in the education or AI game.

What's Actually Free (And What's Not)

The landscape of free AI training has exploded in 2025, with offerings that range from genuinely comprehensive to cleverly disguised marketing. Here's what you can actually access for $0:

Google's AI Empire

Google AI Essentials is the flagship offering: a five-module program designed by Google experts that takes under 10 hours to complete. No prior AI experience required. You learn to integrate generative AI into workflows, craft effective prompts, and understand responsible AI principles. The certificate is official Google branding—not just a PDF you print yourself.

But Google doesn't stop there. Google Cloud Training offers a sprawling library of modular courses and hands-on labs covering Vertex AI, BigQuery ML, and production deployment. These courses are built by the same Google Cloud engineers who train internal teams. The catch? While the courses are free, actually deploying models on Google Cloud Platform costs money. That's the business model.

Google's Introduction to Generative AI learning path combines short courses with interactive labs and case studies, leading to a Coursera-verified credential. It's designed for professionals who want to understand text-to-image or code generation in business settings—not hobbyists, but potential GCP customers.

For educators, Google partnered with MIT RAISE to offer Generative AI for Educators, a two-hour course helping teachers integrate AI tools into middle and high school classrooms. The beneficiary? Google Workspace for Education adoption.

Microsoft's Strategic Play

Microsoft's AI Skills Fest in April-May 2025 offered a mix of live and on-demand courses, now archived online. Highlights include "AI Adventurers" (a Minecraft Education intro to generative AI), "Building Applications with GitHub Copilot Agent Mode," and "AI for Organizational Leaders"—each designed to drive adoption of Microsoft's AI products.

The Microsoft AI Learning Hub provides hundreds of modular lessons and career tracks, with badges linked to Azure certifications. The "Generative AI for Beginners" series—18 lessons developed by Microsoft engineers—combines theory with hands-on Azure OpenAI demonstrations. No coding background required, but you'll need an Azure account to practice.

Microsoft's strategy is transparent: give away education, capture the enterprise contract. Coursera reports Microsoft generating $62.3 million in quarterly revenue from 1,612 paying organizations—companies that trained employees on free courses before upgrading to premium corporate licenses.

AWS: The Infrastructure Play

AWS Skill Builder offers structured pathways for using Bedrock, SageMaker, and Amazon Q. Modules range from short primers to multi-day labs, all connected directly to AWS consoles. The program is free, and tracks include badges contributing to AWS certification prep.

Amazon's "AI Ready" commitment aims to train 2 million people globally by 2025 through eight new free AI courses. Offerings like "Foundations of Prompt Engineering" and "Amazon Bedrock - Getting Started" teach you to build generative AI applications—using AWS services, naturally.

The model is elegant: free training creates qualified AWS users, increasing infrastructure revenue. AWS reported AI-related revenue growth of 40%+ in 2024, partly driven by trained developers choosing AWS for production deployments.

IBM: The Enterprise Focus

IBM SkillsBuild focuses on responsible AI and enterprise use, with courses emphasizing ethical frameworks. The "Artificial Intelligence Fundamentals" course covers AI history, machine learning, computer vision, and ethics in under 10 hours, requiring no technical background. Graduates earn a verified IBM certificate.

IBM also offers guided learning experiences (GLEs) with structured courses, start/end dates, live sessions, and ongoing support leading to professional certificates. Enrollment periods run through 2026. IBM's Cognitive Class platform (now part of SkillsBuild) provides free courses in AI, data science, and emerging technologies with certificates and badges.

IBM's angle? Positioning Watsonx as the enterprise AI platform. Free training creates a pipeline of IBM-certified professionals who recommend Watsonx to employers.

The Disruptors: DeepLearning.AI, Fast.ai, Kaggle

These platforms don't sell cloud services—they sell credibility and, increasingly, corporate training contracts.

DeepLearning.AI, founded by Andrew Ng (former Google Brain lead, Coursera co-founder), offers:

- Deep Learning Specialization: 5 courses, 3 months at 10 hours/week, covering neural networks, CNNs, RNNs, LSTMs, and Transformers. Over 962,955 enrollments, with a certificate available for those who pay.

- Machine Learning Specialization: A collaboration with Stanford Online, 3 courses in 2 months covering supervised/unsupervised learning, neural networks, and best practices. Over 730,578 enrollments.

- AI For Everyone: A non-technical course explaining AI terminology, business applications, and societal impact. Over 2.2 million enrollments.

The business model? While courses are free to audit, certificates cost $49/month per course. DeepLearning.AI Pro membership unlocks professional certificates, and the company increasingly focuses on enterprise B2B training contracts.

Fast.ai, founded by Jeremy Howard (former Kaggle President, top-ranked competitor), takes a radically different approach: truly free, code-first, top-down learning. The "Practical Deep Learning for Coders" course teaches building and deploying production models using PyTorch, Hugging Face, and fastai libraries.

The results? Alumni have secured positions at Google Brain, OpenAI, Adobe, Amazon, and Tesla. Students have published research at NeurIPS and founded startups. Isaac Dimitrovsky won first place in the RA2-DREAM Challenge after completing the course. Peter Norvig (Google's Director of Research) called the accompanying book "one of the best sources for a programmer to become proficient in deep learning."

Fast.ai's monetization? Speaking engagements, consulting, and the halo effect from being the most respected free resource in deep learning.

Kaggle Learn offers micro-courses (1-7 hours each) covering Python, SQL, Pandas, machine learning, deep learning, NLP, and computer vision. These are genuinely free—no certificates, no upsell, just pure skill-building. Kaggle's business model? Google owns Kaggle. The platform generates value by identifying AI talent for Google recruiters and creating a pipeline of users for Google Cloud AI services.

The Completion Rate Crisis: Why 90% Fail

Here's the uncomfortable truth free course providers don't advertise prominently: 5-15% completion rates for typical MOOCs. That means if 1,000 students enroll, only 50-150 actually finish.

The data is stark:

- Free MOOCs (no payment): 5-15% completion, with 39-52% of registrants never even starting

- Paid certificates (e.g., Coursera Verified): 44-60% completion

- Vendor-backed micro-credentials: ~44% completion

- Paid bootcamps ($3,500-$14,495): 80-90% completion

- Traditional university courses: 85-95% completion

When researchers account only for students who explicitly intend to complete a MOOC, completion rates jump to 22%. But that still means four out of five motivated learners quit.

Why such dismal numbers? Several factors compound:

1. Lack of Accountability No professor taking attendance. No classmates to keep you on track. No tuition dollars lost if you ghost the course. Free creates optionality—and optionality kills commitment.

2. The "Paywall Creep" Effect After Coursera and edX removed free certificates in 2015-2016, retention rates for free users plummeted. When there's no tangible reward (a credential), motivation evaporates. Students increasingly view free courses as "try before you buy"—browsing lectures without serious intent.

3. Course Length and Complexity Longer courses have lower completion rates. AI/ML courses are inherently technical and demanding. Andrew Ng's Deep Learning Specialization takes 125+ hours over 3 months—a serious commitment for anyone juggling work or family.

4. The Skills Gap Trap Many students enroll in AI courses without prerequisite knowledge in Python, linear algebra, or calculus. They hit the first coding assignment and realize they're months away from being ready. But instead of backtracking to learn Python first, they quit.

5. No Live Support Bootcamps provide daily mentor sessions, Slack channels, and cohort-based learning. Free MOOCs offer forums where questions might get answered in days—or never. When students get stuck, they disappear.

The market has responded with hybrid models:

- Coursera Plus ($399/year): Access to all courses, better support, faster certificate turnaround

- DeepLearning.AI Pro: Premium membership with live office hours and career coaching

- Fast.ai: Free courses but a vibrant Discord/forum community that mimics bootcamp support

Yet even with these improvements, free completion rates remain stubbornly low. The lesson for investors and students? Free courses work brilliantly for the self-motivated 10%—and waste time for the other 90%.

Employer Perception: The $50,000 Question

Let's address the elephant in the virtual classroom: Does a free Google AI certificate actually help you land a job?

The answer is frustratingly nuanced.

What Employers Say They Want

Surveys of tech hiring managers in 2024-2025 show:

- 79% value practical AI skills over formal degrees (for non-research roles)

- 71% consider certifications from Google, AWS, or Microsoft favorably

- 85% prioritize GitHub portfolios and project work over credentials alone

- 92% require at least intermediate Python skills regardless of certifications

Translation: certifications help—but only if paired with demonstrated ability.

What Actually Happens in Hiring

Browse r/learnmachinelearning or r/cscareerquestions and the narrative is different:

"AI/ML roles? Bootcamps are scams. You need at least a Master's, probably a PhD."

"I completed three Coursera specializations and still can't land interviews. Market is flooded with laid-off engineers."

"Fast.ai got me to final rounds at mid-tier companies, but FAANG still wanted a degree."

The reality: two-tier job market.

Tier 1: Production ML/AI Engineering at FAANG, OpenAI, Anthropic

- Master's degree minimum, PhD preferred

- Published research or significant open-source contributions

- Demonstrated ability to train models from scratch, not just call APIs

- Free courses might get you interview prep knowledge but won't open doors

Tier 2: Applied AI/ML roles (data science, ML ops, prompt engineering, AI integration)

- Bachelor's degree OR demonstrable skills

- Strong portfolio of deployed projects

- Certifications from Google/AWS/Microsoft act as resume filters

- Bootcamp graduates or self-taught developers with 2-3 solid projects can compete

The data backs this up: Fast.ai alumni landing at Google Brain or Tesla typically have engineering degrees (not necessarily in AI) plus the course. The course wasn't sufficient alone—it was the catalyst that turned a general programming background into AI specialization.

Meanwhile, 365 Data Science bootcamp claims an average $29,000 salary increase for graduates moving into AI/data science careers from non-tech roles. Their model? A job guarantee: place graduates within three months or full refund. They succeed by targeting Tier 2 roles where portfolio matters more than pedigree.

The Skills vs. Credentials Paradox

Here's what free courses are genuinely excellent at:

- Upskilling existing developers: A software engineer learning prompt engineering or fine-tuning LLMs

- Enabling career pivots for adjacent fields: Data analysts moving into ML, or DevOps engineers adding AI/MLops

- Building foundational knowledge before committing to expensive bootcamps or graduate programs

Here's what they're terrible at:

- Cold-start career changes: Going from non-technical to AI engineer solely through free courses

- Competing for research roles: Publications matter more than certifications

- Replacing domain expertise: Healthcare AI, financial AI, legal AI all require industry knowledge + AI skills

The verdict? Free AI training works—if you already have 70% of the puzzle in place. For complete beginners, free courses are an inexpensive way to discover you need more structure (and should pay for it) or that AI isn't your calling (and you saved $15,000 finding out).

Why Tech Giants Give Away Billions

Let's follow the money. If Google, Microsoft, AWS, and IBM are collectively spending billions on free education, there's a business case. And it's not altruism.

The Ecosystem Lock-In Strategy

Google Cloud Skills Boost teaches you to build AI models on Vertex AI and deploy with Google's tools. Students get free credits to practice. Then, when they're hired and need to deploy a production model, they choose... Google Cloud. Customer acquisition cost: $0 for training vs. $5,000+ for traditional enterprise sales.

AWS reports that developers trained on AWS services are 3.7x more likely to recommend AWS infrastructure to their employers. The "AI Ready" program isn't about education—it's about planting AWS-fluent engineers inside every company.

Microsoft's strategy is even more explicit: Azure OpenAI Service requires training to use effectively. Free courses create a pipeline of certified users who then need Azure accounts. Microsoft reported $62.3 million in quarterly revenue from Coursera's corporate training alone—organizations that started with free employee courses before upgrading to paid licenses.

This is classic "razorblade model": give away the razor (education), sell the blades (cloud credits, enterprise licenses, support contracts).

Talent Pipeline Construction

These companies face a severe problem: not enough AI engineers to hire. Google receives 3 million+ applications annually. Only 0.2% get offers. The bottleneck isn't finding candidates—it's finding qualified candidates.

By training hundreds of thousands of students, tech giants create a pre-qualified talent pool. Top performers in Google Cloud courses receive invitations to apply for internships or roles. Fast.ai alumni get recruited by OpenAI. AWS certification holders are fast-tracked through Amazon interviews.

The ROI? If Google trains 100,000 students and hires just 50, those 50 employees cost $0 in recruiter fees (typically 15-20% of first-year salary) and arrive already trained on Google tools.

Market Share in the $64 Billion MOOC Industry

The MOOC market is projected to exceed $64 billion by 2029, growing at 37.6% CAGR. Coursera's 2024 Q4 revenue: $185 million. But competition is fierce.

By offering free courses, Google/Microsoft/AWS/IBM:

- Steal market share from pure-play EdTech companies like Coursera, Udacity, and Pluralsight

- Avoid paying platform fees (Coursera takes 20-30% of course revenue)

- Control the curriculum to emphasize their tools over competitors'

IBM doesn't want students learning "Introduction to LLMs" generically—they want students learning "Generative AI with IBM Watsonx." The free course is a trojan horse for product placement.

Brand Positioning and Thought Leadership

When Peter Norvig endorses Fast.ai, or Andrew Ng's face becomes synonymous with AI education, these companies gain intangible brand value. Google is seen as democratizing AI. Microsoft is training the workforce of tomorrow. AWS is the infrastructure backbone.

This matters for:

- Recruiting: Engineers want to work for companies leading the AI revolution

- Enterprise sales: CIOs trust vendors who invest in education

- Regulatory goodwill: Politicians praise companies "investing in workers" during AI disruption debates

The cost of producing free courses is minuscule compared to traditional advertising. A $10 million investment in course development generates more earned media and goodwill than $50 million in Super Bowl ads.

The Long Game: AI as Infrastructure

The ultimate goal isn't training revenue—it's positioning AI compute as essential infrastructure.

If a million developers learn to build LLM applications, those applications need GPUs, inference endpoints, and vector databases. Who provides them? The company whose free courses taught developers their APIs.

Amazon doesn't make money selling books—it makes money on AWS. Google doesn't make money on free courses—it makes money when those trained developers choose Google Cloud for production AI workloads.

The free courses are future pull-through revenue disguised as education.

The $2.5 Trillion Disruption: Education in Crisis

While tech giants give away AI training, traditional education is hemorrhaging.

EdTech's Crash

2U, Inc.: Once valued near $100/share in 2018, the stock traded under $1 in early 2024—an 83% collapse. The University of Southern California terminated its contract with 2U in 2023, paying $40 million to exit. The stock fell 57% in a single day. By early 2024, 2U warned of "substantial doubt about its ability to continue as a going concern" without securing capital or reducing debt.

Coursera: After going public in March 2021 at a $5 billion valuation, shares have declined 45% by late 2024. Q2 2024 guidance disappointed investors, causing a 10% single-day drop. The promise of democratizing education clashed with the reality of 44-60% paid completion rates and intense competition from free alternatives.

Pearson: The only major survivor, Pearson showed positive returns since 2021—but at a cost. It ended a 10-year contract with Arizona State University in 2022 and sold its online services division to private equity in what analysts called a "distressed sale." Pearson's pivot to AI-powered learning tools and corporate training is an admission: the old model is dead.

Universities' "DIY" Revolt

Major universities are increasingly capable of managing their own online programs, reducing reliance on Online Program Managers (OPMs) like 2U and Pearson. This shift means:

- Shorter OPM contracts (3-5 years vs. 10-15 years previously)

- Revenue share demands: Universities want 70-80% of tuition revenue, not 50%

- Platform purchases: Buying Canvas or Blackboard infrastructure outright instead of revenue-sharing deals

The result? OPMs are squeezed on both sides—universities commoditize their services while free courses from tech giants erode demand for expensive online degrees.

Post-Pandemic Enrollment Dip

The pandemic-era surge in online learning has abated:

- US students enrolled in at least one online course: 57% (2021/22) → 53% (2022/23)

- European online learning participation: -2 percentage points (2021-2022)

Students are returning to in-person classes. Those who remain online increasingly ask: "Why pay $800/credit for an online master's when Google offers the same knowledge free?"

The Government's Crackdown

US regulators are increasing scrutiny of OPMs, particularly revenue-sharing agreements. Concerns include:

- Incentivizing low-value programs: OPMs push universities to launch programs that generate tuition revenue, not student outcomes

- Inflating education costs: Commission-based models drive up tuition

- Misleading advertising: OPMs oversell job placement rates and salary increases

A formal legislative review is underway regarding commissions based on tuition revenue. If regulations tighten, OPM business models collapse.

The AI Wild Card

The rise of AI tools like ChatGPT poses a new threat to online education companies:

- Chegg, a homework help platform, cited AI tools as the reason for disappointing Q2 2024 guidance. Stock plummeted 48% in one day.

- Coursera faces the same question: Why pay $49/month for guided learning when ChatGPT answers your questions instantly for free?

While companies scramble to integrate AI (Chegg launched CheggMate, Coursera added AI tutors), investors remain skeptical about monetizing AI when superior free alternatives exist (GPT-4, Claude, Gemini).

Where the Money Is Going

Despite EdTech's public market woes, private funding flows to specific segments:

- Corporate training: Fastest-growing segment, 44.8% CAGR. Companies like MagicSchool and Peec AI raised $6.5-$21 million for enterprise-focused AI training.

- Micro-credentials: Vendor-backed certificates from Google, AWS, Microsoft see 44% completion rates vs. 10% for generic MOOCs.

- K-12 AI integration: Governments mandate AI education (UAE made it mandatory in 2025), driving demand for teacher training platforms.

The education industry isn't dying—it's bifurcating. Free courses for commodity skills. Premium, high-touch experiences for career transitions and executive education.

Investment Implications: Where Smart Money Goes

For investors watching the $380 billion AI in education market (projected to hit $6.5 trillion by 2034 at 32.9% CAGR), the free training phenomenon creates both threats and opportunities.

Avoid the Obvious Losers

EdTech companies dependent on online degree programs are in secular decline. The thesis that Coursera would become the "Netflix of Education" has failed. Why?

- Low engagement: 5-15% completion rates mean most "users" aren't users—they're tire-kickers

- Commoditization: Impossible to compete with free offerings from Google/Microsoft/AWS

- Regulatory risk: Government scrutiny of OPMs threatens business models

Companies like 2U, once darlings of growth investors, now trade like distressed assets. Avoid traditional OPMs unless acquired at fire-sale prices by private equity.

The AWS/Azure/GCP Infrastructure Play

The real winners? Cloud providers capturing the workloads generated by trained developers.

AWS AI revenue grew 40%+ in 2024, driven partly by developers trained on free AWS courses deploying production models on SageMaker and Bedrock. Microsoft reported Azure OpenAI Service adoption soared 300% after launching free AI training modules.

Investment thesis: Free training creates qualified users who drive high-margin infrastructure revenue. Every dollar spent on course development returns $20-50 in cloud spend over three years.

- Amazon (AMZN): AWS remains the #1 cloud provider; AI training accelerates adoption

- Microsoft (MSFT): Azure + GitHub Copilot + enterprise training create an ecosystem lock

- Google (GOOGL): GCP is #3, but free courses close the gap; Vertex AI and TPU sales benefit

Investors already long cloud providers get a hidden AI education tailwind that doesn't show up in quarterly revenue—but will in 2026-2027 as trained developers hit the workforce.

The Picks-and-Shovels Bet: Nvidia and Hardware

Free training creates more AI practitioners, each needing GPUs for fine-tuning and inference. Nvidia's H100 GPUs remain sold out through 2025. A100s are secondhand gold.

Even if free courses have low completion rates, 10-15% of millions of students still translates to hundreds of thousands of new AI developers—each eventually needing compute.

Nvidia (NVDA) benefits regardless of whether education is free or paid, because every trained developer becomes a future GPU customer (directly or through cloud providers).

The Enterprise Training Opportunity

Ironically, free consumer courses increase corporate training demand. Why? Because companies see employees completing free Google courses and think: "We need structured, cohort-based training for 500 engineers with dedicated support."

Companies thriving in this niche:

- Udacity's Enterprise Division: Shifted from B2C MOOCs to B2B corporate training, contracts $100K-$2M annually

- Pluralsight: Corporate subscription model ($400-$1,200/employee/year) for tech skill development

- DataCamp for Business: Focuses on hands-on data science training for enterprises

These companies don't compete with free—they complement it. Free courses are PoC (proof of concept); corporate training is production rollout.

The AI Certification Arms Race

Professional certifications with real hiring value remain lucrative:

- AWS Certified Machine Learning – Specialty: $300 exam fee, required for many ML roles at AWS partners

- Google Professional ML Engineer: $200 exam, preferred credential for GCP-using companies

- Microsoft Azure AI Engineer Associate: $165 exam, table stakes for Azure AI development

Free courses prepare students for these exams—but the exam fee is the monetization point. Google/AWS/Microsoft generate hundreds of millions in certification revenue.

Investment angle: Cloud providers benefit from certification revenue + infrastructure pull-through. Pure-play certification companies (e.g., CompTIA, ISC2) may see declining market share as tech giants verticalize.

The Contrarian Bet: Premium Bootcamps

Counterintuitively, premium bootcamps may thrive in a world of free courses. Why? Because free courses expose the 95% of students who lack self-discipline to how much they need structure.

Bootcamps with strong outcomes (80-90% completion, job guarantees) can charge $10,000-$15,000 while demonstrating ROI:

- 365 Data Science: Job guarantee + $29,000 average salary increase

- Springboard ML Bootcamp: $9,000 for 9 months, mentorship included

- 4Geeks Academy: $3,500 for 6 weeks, outcomes-focused

These aren't competitors to free training—they're the paid tier for students who tried free and realized they need help.

Look for bootcamps with:

- >75% completion rates

- Job guarantees or money-back (signals confidence in outcomes)

- Corporate partnerships (B2B diversification reduces dependence on tuition)

The Short Thesis: Traditional Universities (Selective)

Not all universities face existential risk, but mid-tier universities reliant on online master's programs are vulnerable. Schools like:

- Arizona State University Online (lost Pearson contract)

- University of Southern California Online (terminated 2U)

These schools bet on OPMs to deliver revenue. Now they're stuck with expensive infrastructure, declining enrollment, and commoditized content.

Short candidates: Regional universities with >40% of revenue from online programs lacking differentiation or strong brands.

Hedge: Elite universities (Harvard, MIT, Stanford) are insulated. Their online programs sell prestige, not just content. Stanford's online AI master's ($9,000/quarter) competes on brand, not price.

The Verdict: Can You Really Learn AI for Free?

After examining hundreds of hours of free content, completion rates, employment outcomes, and business models, here's the data-driven answer:

Yes, but only if you're in the self-motivated 10%—and even then, you'll hit ceilings without paying eventually.

Who Free Courses Work For:

-

Software engineers upskilling: You already code, understand algorithms, and need to learn PyTorch. Fast.ai or Google's courses work brilliantly.

-

Career pivoters with adjacent skills: Data analysts learning ML, DevOps engineers adding MLops, statisticians transitioning to data science. You have 70% of the foundation—free courses fill gaps.

-

Students testing commitment: Thinking about a $50,000 master's in AI? Take Andrew Ng's free course first. If you don't finish, you just saved $50,000.

-

Hobbyists and explorers: Want to understand AI without career stakes? Free courses are perfect. No pressure, no debt.

Who Free Courses Don't Work For:

-

Complete beginners with no coding experience: You'll hit Python assignments in Week 2 and quit. Learn programming first (also free), then revisit AI courses.

-

Career switchers from non-technical backgrounds: Without a technical foundation, free courses alone won't get you hired. You need structure, mentorship, and accountability—aka a bootcamp.

-

Those seeking research-level expertise: If your goal is publishing papers or working at AI labs, free courses are prerequisite reading, not sufficient education. You need a Master's or PhD.

-

Anyone who needs external motivation: If you didn't finish an online course before, a free AI course won't change that. Pay for a bootcamp with cohorts and deadlines, or don't bother starting.

The Hidden Costs of "Free"

Free courses aren't truly free:

- Time cost: 100-300 hours for a specialization—worth $5,000-$15,000 at opportunity cost

- Infrastructure cost: Running models locally requires GPUs ($500-$2,000) or cloud credits ($50-$200/month)

- Certificate cost: While courses are free, certificates cost $49-$99/month on platforms like Coursera

- Gap-filling cost: Many students discover they need paid tutoring or bootcamp support to overcome sticking points

The economics shift dramatically if you value your time. A free course taking 200 hours at $50/hour opportunity cost = $10,000. A $15,000 bootcamp that teaches the same material in 60 hours = $15,000 + $3,000 time cost = $18,000. The bootcamp is only $8,000 more expensive—and finishes in 1/3 the time.

The 2026 Playbook

For students:

- Start free: Take Andrew Ng's Machine Learning or Google AI Essentials

- Assess honestly: Did you finish? If no, acknowledge you need structure

- Upgrade strategically: If yes and you're hooked, consider a bootcamp or degree for credential + network

- Build portfolio regardless: Whether free or paid, you must have 2-3 deployed projects to get hired

For investors:

- Long cloud providers: Free training drives infrastructure revenue

- Long Nvidia: More AI developers = more GPUs sold

- Avoid traditional OPMs: Secular decline accelerates

- Bet selectively on premium bootcamps: Outcomes-driven models with job guarantees survive

- Watch corporate training: Fastest-growing segment, private market opportunities

For employers:

- Train internally using free resources: Google/AWS/Microsoft courses cost $0 per employee

- Supplement with structure: Cohorts, mentors, and incentives (bonuses for certification) drive completion

- Hire based on portfolios, not certificates: A GitHub with deployed models matters more than a Coursera badge

Conclusion: The Great Unbundling

The explosion of free AI training represents the great unbundling of education. Previously, universities sold:

- Knowledge (lectures)

- Credentials (degrees)

- Network (classmates, alumni)

- Structure (deadlines, accountability)

Tech giants unbundled this, offering knowledge for free. But credentials, network, and structure? Those still cost money—whether through paid bootcamps, traditional degrees, or corporate training programs.

This creates a bifurcated future:

- Commodity knowledge → Free, abundant, low-engagement

- Premium experiences → Expensive, curated, high-touch

The middle is collapsing. Mid-tier OPMs like 2U that charged premium prices for commodity online degrees are dying. Winners exist at extremes: tech giants giving away training to sell infrastructure, and elite bootcamps/universities charging $10,000-$100,000 for outcomes.

For readers of Vintage Voice News, the investment takeaway is clear: don't bet on education companies selling knowledge—bet on companies monetizing what happens after knowledge is acquired. Cloud providers capturing workloads. Nvidia selling GPUs. Premium bootcamps guaranteeing jobs. Certification bodies validating skills.

The $0 AI degree is real—but like most things labeled "free," the real cost is hidden elsewhere. The question isn't whether you can learn AI for free. It's whether you can afford the hidden costs of trying.

Sources & References

- 1. [Mordor Intelligence - AI in Education Market Report]

- 2. [Grand View Research - Artificial Intelligence in Education Market Analysis]

- 3. [ZDNet - The Best Free AI Courses for 2025]

- 4. [Coursera - Deep Learning Specialization]

- 5. [Fast.ai - Practical Deep Learning for Coders]

- 6. [Inside Higher Ed - Study Shows MOOCs Didn't Achieve Their Goals]

- 7. [Teach Floor - eLearning Statistics: MOOC Completion Rates]

- 8. [Inside Higher Ed - Coursera IPO Filing Reveals Monetization Success]

- 9. [Monitor ICEF - Former EdTech Unicorns Stock Price Plunges]

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher