Nvidia's $5 Trillion Milestone: What It Means for AI's Future

On October 29, 2025, Nvidia became the first company in history to reach a $5 trillion market valuation—a milestone that took just three months after crossing $4 trillion. With over $500 billion in AI chip orders, 90% market dominance, and Q3 earnings on the horizon, Nvidia's rise reflects both AI's explosive growth and growing concerns about sustainability, competition, and whether the AI boom represents visionary investment or a speculative bubble.

Nvidia's $5 Trillion Milestone: What It Means for AI's Future

On October 29, 2025, Nvidia Corporation achieved what no company had done before: it reached a $5 trillion market valuation. The milestone came just three months after the chipmaker crossed $4 trillion in July 2025, capping a meteoric rise that has made Nvidia the world's most valuable company, surpassing giants like Microsoft and Apple. The stock surge—more than 50% in 2025 alone—reflects one dominant narrative: artificial intelligence is transforming from experimental technology to essential infrastructure, and Nvidia has positioned itself as the indispensable backbone.

But this extraordinary valuation raises profound questions. Is Nvidia's dominance sustainable as competitors like AMD, Intel, and Qualcomm launch competing products? Will the company's upcoming Q3 earnings on November 19, 2025, validate stratospheric investor expectations? And most fundamentally, does Nvidia's $5 trillion market cap represent rational pricing of AI's transformative potential, or is it a warning sign of a speculative bubble that could destabilize markets?

This article examines Nvidia's historic milestone through multiple lenses: the forces propelling its rise, the competitive landscape intensifying around AI chips, the massive infrastructure investments driving demand, upcoming earnings that could shape sentiment, and the risks—from regulatory scrutiny to energy constraints—that could derail the AI revolution Nvidia is betting on.

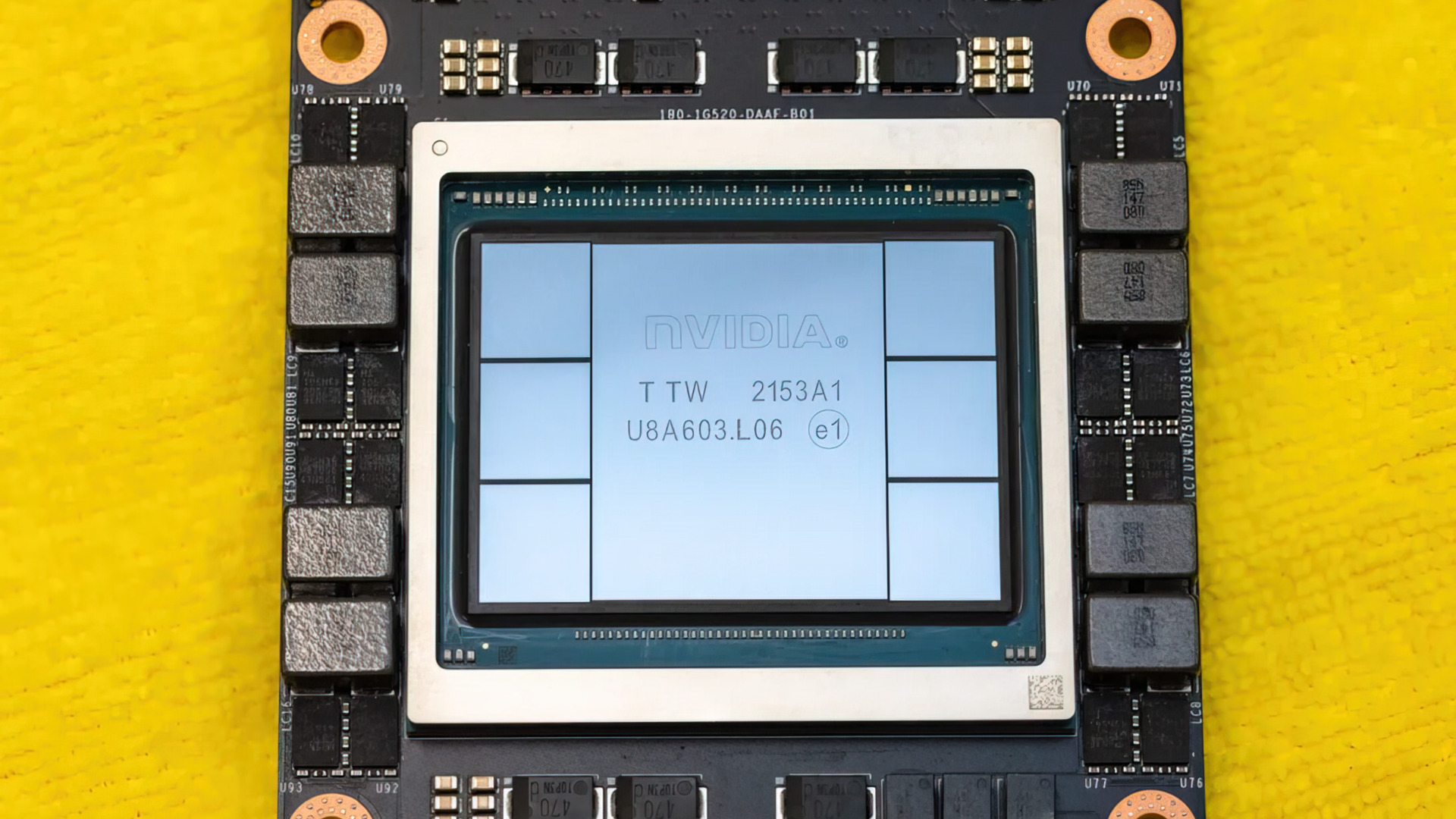

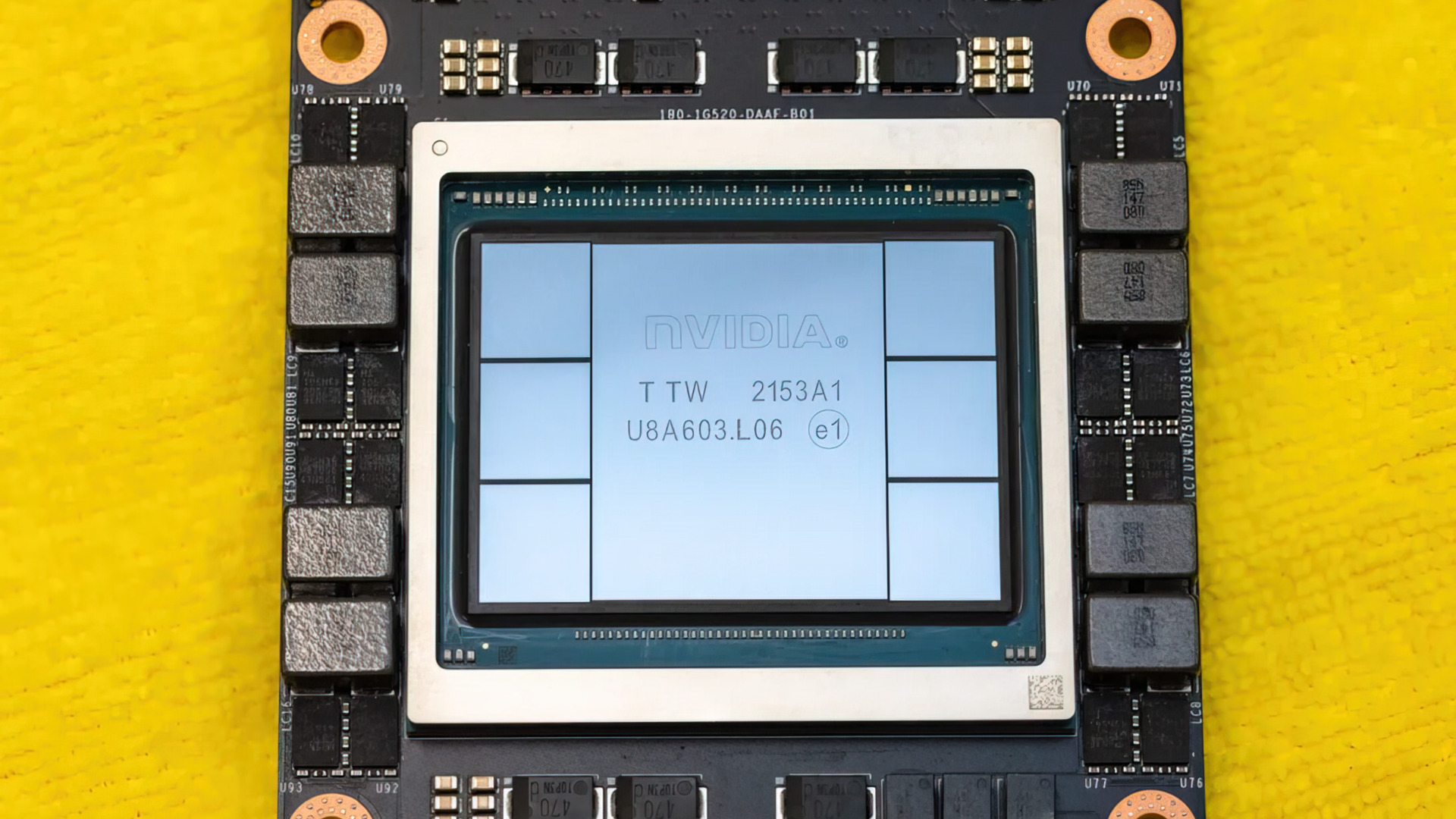

The hardware behind the hype: Nvidia's H100 and Blackwell chips have become the gold standard for AI training and inference

The hardware behind the hype: Nvidia's H100 and Blackwell chips have become the gold standard for AI training and inference

The Path to $5 Trillion: Three Months That Changed Everything

Nvidia's journey to $5 trillion wasn't gradual—it was explosive. In July 2025, the company crossed $4 trillion amid growing enthusiasm for generative AI applications. By late October, three catalysts converged to push valuation even higher:

Record AI Chip Orders: At Nvidia's GTC AI conference on October 28, 2025, CEO Jensen Huang announced over $500 billion in AI chip orders booked through 2026. These orders span Nvidia's latest architectures—the Blackwell B100 and B200 accelerators, and the upcoming Rubin Superchip—and come from hyperscalers like Amazon Web Services, Microsoft Azure, Google Cloud, and Meta, as well as enterprise customers and government agencies. Huang revealed plans to build seven supercomputers for the U.S. government, underscoring Nvidia's role not just in commercial AI but in national security and scientific research.

The order backlog represents unprecedented visibility into future revenue. Unlike consumer electronics or even traditional enterprise software, AI infrastructure involves multi-year commitments from customers making billion-dollar bets on compute capacity. This pipeline gives Nvidia financial certainty that few companies at any scale can match, reducing earnings volatility and justifying premium valuation multiples.

Geopolitical Developments: On October 31, 2025, U.S. President Donald Trump met with Chinese President Xi Jinping to discuss technology trade, specifically mentioning Nvidia's Blackwell chips during remarks. Trump highlighted the chip's advanced capabilities and raised the possibility of easing export restrictions that have limited Nvidia's access to China's massive AI market. Current U.S. export controls have reduced Nvidia's China market share from approximately 95% in 2022 to around 50% in 2025, costing billions in revenue. Any relaxation could restore significant lost business, adding to investor optimism.

However, the geopolitical dimension cuts both ways. Nvidia's dominance in AI chips has made it a focal point in U.S.-China tech rivalry, with policymakers viewing advanced semiconductors as strategic assets. Export restrictions could tighten further depending on political developments, and antitrust investigations—already underway in China—could limit Nvidia's market power globally. The company's fate is increasingly tied to decisions made in Washington and Beijing, not just Silicon Valley boardrooms.

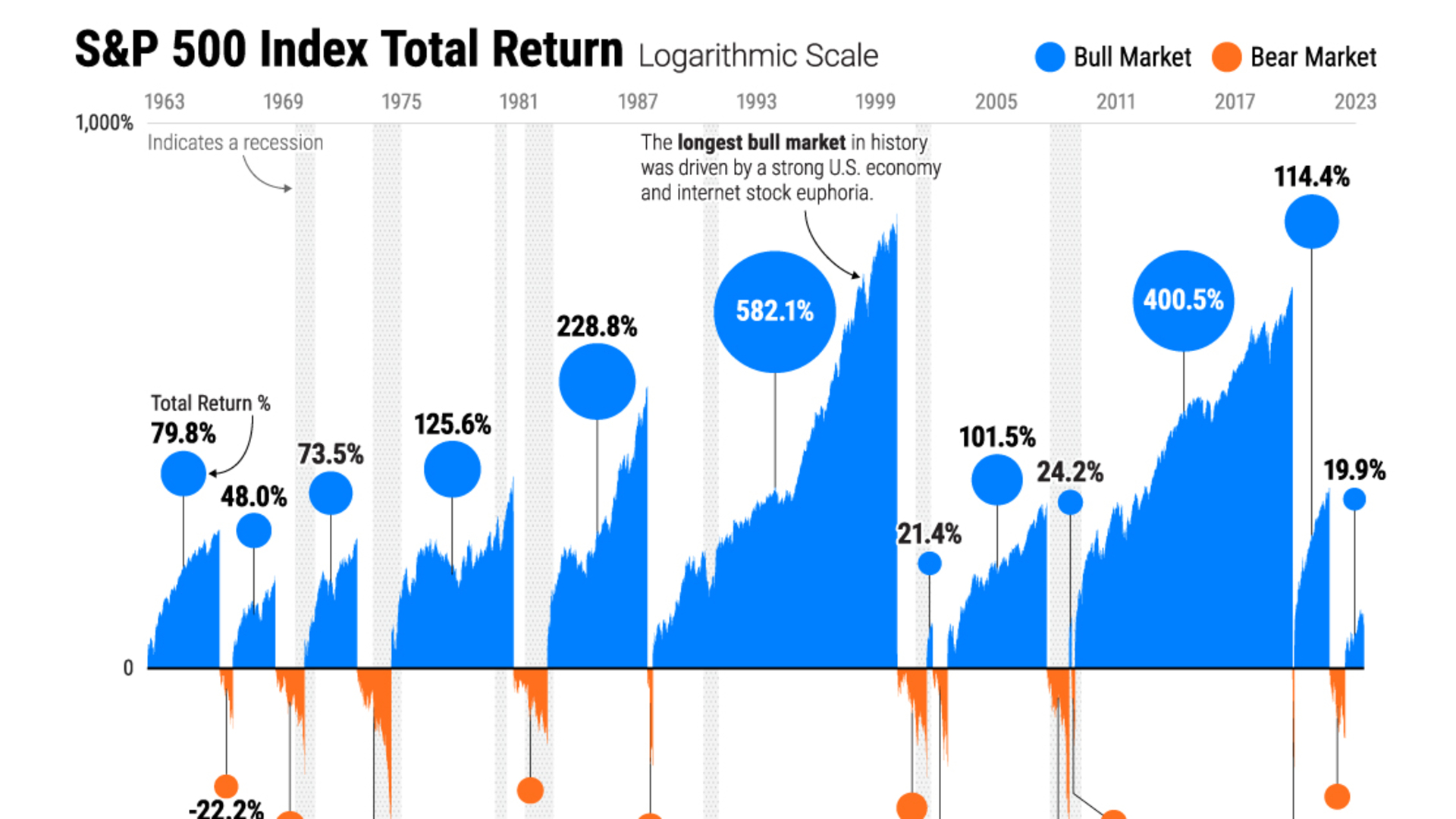

Market Dynamics and AI Boom Psychology: Beyond specific announcements, Nvidia's rise reflects broader investor belief that AI represents a once-in-a-generation technological shift comparable to the internet's emergence in the 1990s or mobile computing in the 2000s. Companies are collectively spending over $200 billion annually on AI infrastructure, with projections suggesting $3-4 trillion in cumulative investment by 2030. Nvidia captures an estimated 70-90% of spending on AI accelerators, positioning it as the primary beneficiary of this capital deployment.

The psychology driving Nvidia's valuation resembles momentum-based investing: as the stock rises, more investors fear missing out, creating self-reinforcing demand. Nvidia now accounts for a larger market capitalization than the equity markets of most countries and exceeds six of the eleven sectors in the S&P 500 Index. This concentration creates systemic risk—if Nvidia stumbles, it could drag down broader indices, as the company has driven much of the S&P 500's gains since 2023.

Nvidia's stock trajectory reflects explosive growth driven by AI demand, but also raises questions about valuation sustainability

Nvidia's stock trajectory reflects explosive growth driven by AI demand, but also raises questions about valuation sustainability

Nvidia's Competitive Moat: Why Dominance Isn't Just About Hardware

Nvidia's market leadership isn't solely a function of superior chips, though its hardware advantages are real. The company has built a formidable competitive ecosystem that creates high switching costs for customers, making it difficult for rivals to capture share even with competitive products.

The CUDA Ecosystem: Nvidia's most powerful asset may be CUDA (Compute Unified Device Architecture), its software platform for GPU programming. Launched in 2006, CUDA has become the de facto standard for AI development, with millions of developers trained on its tools and frameworks. Major AI libraries like TensorFlow and PyTorch are optimized for CUDA, and countless research papers and production systems assume Nvidia GPUs.

This creates immense inertia. Even if competitors like AMD offer chips with comparable or superior raw performance, transitioning requires rewriting code, retraining engineers, and risking compatibility issues. For companies running mission-critical AI workloads—serving millions of users or processing petabytes of data—these risks are often unacceptable. AMD's ROCm software attempts to challenge CUDA, but it lags significantly in maturity and adoption, limiting AMD's ability to convert hardware advantages into market share.

Vertical Integration and Partnerships: Nvidia has expanded beyond GPUs into complete system solutions. The company's DGX servers integrate chips, networking, cooling, and software into turnkey AI infrastructure. Its partnerships with cloud providers, system integrators like Dell and Cisco, and contract manufacturers like Foxconn and Wistron create a supply chain optimized for rapid deployment. CEO Jensen Huang describes this as moving from selling GPUs to selling "AI factories"—complete ecosystems that reduce complexity for customers while increasing Nvidia's revenue per deployment.

Nvidia also benefits from deep collaboration with Taiwan Semiconductor Manufacturing Company (TSMC), which produces its advanced chips using cutting-edge 4-nanometer and 3-nanometer processes. These manufacturing partnerships give Nvidia access to the most advanced semiconductor nodes before competitors, maintaining performance leadership even as rivals introduce new architectures.

Brand and Talent: In AI circles, Nvidia has become synonymous with performance and reliability. Top AI researchers and engineers prefer Nvidia hardware, creating a virtuous cycle where the best talent produces the best results on Nvidia platforms, reinforcing its dominance. The company's annual GTC conference has become a premier industry event, with tens of thousands attending to learn about the latest technologies. This brand power translates into premium pricing—Nvidia's H100 GPUs cost $30,000-50,000 each, yet demand consistently exceeds supply.

Jensen Huang, Nvidia's CEO, has led the company's transformation from a gaming graphics specialist to the backbone of the AI industry

Jensen Huang, Nvidia's CEO, has led the company's transformation from a gaming graphics specialist to the backbone of the AI industry

Competition Intensifies: AMD, Intel, and the Custom Silicon Threat

Despite Nvidia's strengths, competition is accelerating, and several trends could erode market share over the next few years:

AMD's Strategic Push: Advanced Micro Devices holds only about 4% of the AI accelerator market but is making aggressive moves. The company's Instinct MI300X series targets AI training and inference with compelling price-performance ratios. In October 2025, AMD announced the MI350 series, offering up to 4x performance improvements over previous generations and 40% better tokens-per-dollar than Nvidia's B200 accelerators. Oracle Cloud committed to deploying 50,000 MI450 chips, and OpenAI announced a partnership to deploy 6 gigawatts of AMD systems, potentially giving AMD a 10% equity stake in OpenAI if milestones are met.

AMD's challenge is software. While hardware specifications are competitive, ROCm's immaturity limits adoption among customers without extensive engineering resources. If AMD can improve software tooling—through internal development or by attracting a critical mass of developers—it could capture growing market share, especially in inference workloads where switching costs are lower than in training.

Intel's Gaudi Chips and Qualcomm's Entry: Intel, once the semiconductor industry's dominant force, is attempting to regain relevance in AI with its Gaudi 3 accelerators. Market research projects Intel could capture 8.7% of the AI training market by late 2025, though overall share remains below 1%. The company faces challenges beyond technology, including organizational turmoil and manufacturing struggles, making it a less serious threat to Nvidia than AMD.

More intriguing is Qualcomm's October 2025 entry with AI200 and AI250 chips targeting inference workloads. These chips emphasize power efficiency and cost advantages, offering up to 768 GB of memory support—higher than current Nvidia or AMD offerings. Qualcomm's announcement drove an 11% stock surge, signaling investor belief in opportunities beyond training-focused GPUs. If AI inference becomes the primary growth market as models mature, Qualcomm could disrupt Nvidia's dominance in deployment even if it can't compete in training.

Custom Silicon from Hyperscalers: Perhaps the greatest long-term threat comes from Nvidia's own largest customers. Google's Tensor Processing Units (TPUs) already power much of its internal AI infrastructure. Amazon Web Services has developed Trainium and Inferentia chips optimized for training and inference. Microsoft is investing in proprietary silicon in partnership with AMD. Meta is reportedly exploring custom chips for its data centers.

These custom solutions reduce dependency on Nvidia, giving hyperscalers negotiating leverage on pricing and supply. While unlikely to eliminate Nvidia purchases entirely—the CUDA ecosystem and performance advantages remain compelling—custom chips could limit Nvidia's growth as cloud providers optimize for cost and control. If hyperscalers collectively shifted 20-30% of AI workloads to custom silicon, it would represent tens of billions in lost revenue for Nvidia over several years.

Inside an AI data center: Nvidia's GPUs power the infrastructure behind ChatGPT, image generation, and countless enterprise AI applications

Inside an AI data center: Nvidia's GPUs power the infrastructure behind ChatGPT, image generation, and countless enterprise AI applications

Q3 Earnings: A Critical Test on November 19

Nvidia's fiscal Q3 2025 earnings report on November 19, 2025, will provide the first major financial snapshot since the $5 trillion milestone. Analyst expectations are high, with consensus estimates around $33-35 billion in revenue—a 94% year-over-year increase—and non-GAAP earnings per share of approximately $0.81. The data center segment, accounting for nearly 90% of revenue, is expected to show continued explosive growth, potentially reaching $30-31 billion.

What Investors Are Watching:

-

Blackwell Ramp and Demand Visibility: CEO Jensen Huang has described demand for Nvidia's next-generation Blackwell chips as "insane," with expectations that demand will exceed supply for several quarters. Investors want clarity on production timelines, any technical issues (earlier reports mentioned overheating concerns), and the pace at which Blackwell will replace older Hopper-generation products. Strong Blackwell guidance would reinforce the bull case; delays or production problems could trigger selling.

-

Gross Margins: Nvidia has maintained impressive gross margins around 75% despite rising costs. Any margin compression could signal pricing pressure from competition or increased costs in supply chain and manufacturing. Stable or expanding margins would demonstrate pricing power and operational efficiency.

-

Q4 Guidance: Nvidia typically guides the next quarter conservatively, then beats expectations. Current estimates suggest Q4 revenue around $37.5 billion, implying 70% year-over-year growth. If guidance falls short, even modestly, it could spark concerns that AI spending is slowing, potentially triggering a broader tech sell-off given Nvidia's index weight.

-

Customer Concentration and Diversification: Hyperscalers represent the majority of Nvidia's revenue. Investors want evidence of broadening demand—more enterprise customers, government contracts, and international buyers—to reduce concentration risk. If growth remains overly dependent on a handful of cloud providers, it raises vulnerability to those customers reducing purchases or developing alternatives.

Historical Context and Risks: Nvidia has consistently beaten earnings expectations over the past two years, often by significant margins, driving post-earnings stock rallies. However, at a $5 trillion valuation, expectations are priced to perfection. Even a modest miss or cautious guidance could trigger sharp declines, especially if broader market sentiment turns negative. Analysts from institutions like the International Monetary Fund and Bank of England have warned that inflated tech valuations could lead to market instability, with Nvidia specifically cited as a potential flashpoint.

The Infrastructure Spending Boom: Nvidia's Tailwind and Achilles' Heel

Nvidia's growth is inextricably linked to the AI infrastructure spending boom. Tech companies are collectively investing over $200 billion annually in data centers, specialized chips, and energy systems. Microsoft announced $80 billion in AI infrastructure spending, Amazon allocated $125 billion for 2025 capital expenditures, Google raised forecasts to $91-93 billion, and Meta committed $70-72 billion. These investments create sustained demand for Nvidia's products, as each new data center requires thousands of GPUs.

OpenAI's $500 billion Stargate initiative exemplifies this trend. The partnership with Oracle and SoftBank aims to build 10 gigawatts of AI computing capacity across multiple U.S. sites, potentially requiring millions of Nvidia GPUs worth tens of billions of dollars. Nvidia has secured $100 billion in investment commitments to OpenAI, positioning it as the primary hardware beneficiary.

The Sustainability Question: Yet this spending spree raises fundamental questions. Are companies investing rationally based on expected returns, or are they caught in a competitive arms race where no one can afford to fall behind? Meta's $70-72 billion in capital expenditures dwarfs its annual operating income, and CEO Mark Zuckerberg has struggled to articulate how AI will generate proportional revenue. Meta's stock dropped 12% after Q3 earnings amid concerns about AI product viability, erasing over $200 billion in market cap.

If AI fails to deliver revenue growth justifying these investments, companies could sharply reduce infrastructure spending, devastating demand for Nvidia's chips. This scenario becomes more likely if economic conditions weaken, interest rates remain elevated, or shareholders demand profitability over speculative bets. Historical parallels to the dot-com bubble and telecommunications overinvestment in the early 2000s—when massive infrastructure buildouts preceded demand, creating stranded assets—loom large in skeptics' minds.

Energy Constraints as a Limiting Factor: AI infrastructure faces a critical bottleneck: power. Training large models requires 30+ megawatts continuously, and data centers collectively consumed 183 terawatt-hours in the U.S. in 2024, with projections reaching 426 terawatt-hours by 2030. Power availability is now the primary constraint on data center location, with grid interconnection queues stretching years in many regions.

This could limit infrastructure expansion regardless of capital availability or chip supply, capping Nvidia's addressable market. If energy constraints prevent planned data center construction, the $500 billion in chip orders Nvidia has booked could face delays or cancellations. Utilities are struggling to meet demand, and environmental concerns about fossil fuel use and water consumption are creating political resistance in some areas. Nvidia's fate may ultimately depend as much on energy policy and grid infrastructure as on its technological advantages.

The Bull and Bear Cases: What $5 Trillion Means for Investors

The Bull Case: Nvidia's valuation reflects its role as the indispensable infrastructure provider for the most transformative technology of the decade. AI is moving from experimentation to production, with enterprises across industries—healthcare, finance, retail, manufacturing—deploying AI-powered applications that require Nvidia's GPUs. The $500 billion order backlog provides years of revenue visibility. Software moats through CUDA create sustainable competitive advantages. And AI's potential—from scientific discovery to autonomous systems to personalized medicine—justifies massive investment. Forward price-to-earnings ratios around 31x, while high, aren't absurd given growth rates exceeding 50% annually. Nvidia could reach $8.5 trillion in market cap if AI spending accelerates as some analysts project, with one firm (Loop Capital) setting a $350 price target implying that valuation.

The Bear Case: Nvidia's $5 trillion valuation prices in flawless execution and continued explosive growth, leaving little room for disappointment. Competition is intensifying as AMD improves software, hyperscalers deploy custom chips, and new entrants like Qualcomm target inference. Nvidia's China business faces persistent geopolitical risks. Energy constraints could limit infrastructure expansion regardless of demand. Most critically, the AI spending boom may represent speculative euphoria rather than rational investment, with companies unable to generate returns justifying hundreds of billions in capital expenditures. If enthusiasm wanes, infrastructure spending could collapse, devastating GPU demand. Historical bubbles—dot-com, crypto, SPACs—all featured periods of extreme valuations justified by transformative narratives, followed by brutal corrections when fundamentals reasserted themselves. Nvidia at $5 trillion may represent the peak of AI hype rather than the beginning of durable growth.

The Likely Reality: Probably somewhere in between. AI is genuinely transformative and will reshape industries over the coming decade, but expectations have gotten ahead of reality. Nvidia will face increasing competition and may see gross margins compress as rivals gain share and customers demand pricing concessions. Infrastructure spending may moderate as companies become more disciplined about ROI, but baseline demand will remain robust as AI becomes essential infrastructure. Nvidia's stock could stagnate or decline from current levels even as revenue continues growing, simply because valuation multiples normalize from elevated levels. For long-term investors, Nvidia remains a high-conviction position, but expecting continued 50% annual gains from a $5 trillion base is unrealistic.

Conclusion: Nvidia's Milestone and AI's Crossroads

Nvidia's $5 trillion valuation represents far more than one company's success—it crystallizes the hopes, fears, and uncertainties surrounding artificial intelligence itself. The milestone validates AI as a defining technology of the 2020s, powerful enough to justify reshaping global capital allocation. Yet it also raises uncomfortable questions about sustainability, competition, and whether today's exuberance will look visionary or delusional in hindsight.

The coming months will be telling. Nvidia's Q3 earnings on November 19, 2025, will provide critical evidence of demand strength and operational execution. Infrastructure spending trends will reveal whether tech giants maintain investment fervor or begin pulling back. Competitive dynamics will show whether Nvidia's moats withstand assault from well-funded rivals. And broader economic conditions—interest rates, geopolitical tensions, regulatory actions—will shape the environment in which AI's promise must transform into profitability.

For now, Nvidia stands atop the technology world, the first company to reach $5 trillion and the most visible symbol of AI's transformative potential. Whether that position represents a peak to defend or a platform for further growth will define not just Nvidia's future, but the trajectory of the AI revolution it has enabled.

-

Al Jazeera. "Chipmaker Nvidia Hits $5 Trillion Valuation." October 29, 2025. https://www.aljazeera.com/economy/2025/10/29/chipmaker-nvidia-hits-5-trillion-valuation

-

CNN Business. "Nvidia 5 Trillion Valuation AI." October 29, 2025. https://www.cnn.com/2025/10/29/tech/nvidia-5-trillion-valuation-ai

-

CNBC. "Nvidia on Track to Hit Historic $5 Trillion Valuation Amid AI Rally." October 29, 2025. https://www.cnbc.com/2025/10/29/nvidia-on-track-to-hit-historic-5-trillion-valuation-amid-ai-rally.html

-

Bloomberg. "Nvidia Is Worth $5 Trillion. Here's What It Means for the Market." November 2, 2025. https://www.bloomberg.com/news/articles/2025-11-02/nvidia-is-worth-5-trillion-here-s-what-it-means-for-the-market

-

Bloomberg. "Nvidia Can Hit $8.5 Trillion on Golden Wave of AI, Loop Says." November 3, 2025. https://www.bloomberg.com/news/articles/2025-11-03/nvidia-can-hit-8-5-trillion-on-golden-wave-of-ai-loop-says

-

Fortune. "Nvidia First $5 Trillion Company CEO Jensen Huang 500 Billion Revenue." October 29, 2025. https://fortune.com/2025/10/29/nvidia-first-5-trillion-company-ceo-jensen-huang-500-billion-revenue-blackwell-rubin-gpus-china/

-

Financial Content. "Nvidia's AI Reign: Fueling Market Gains and Forging a New Industrial Revolution." October 29, 2025. https://markets.financialcontent.com/stocks/article/marketminute-2025-10-29-nvidias-ai-reign-fueling-market-gains-and-forging-a-new-industrial-revolution

-

Investing.com. "Top AI Chip Stocks to Watch in 2025: Nvidia Leads the Pack." October 2025. https://www.investing.com/news/stock-market-news/top-ai-chip-stocks-to-watch-in-2025-nvidia-leads-the-pack-93CH-4310800

-

The Fool. "Nvidia vs AMD: Which Is the Better AI Chip Stock for 2025?" December 30, 2024. https://www.fool.com/investing/2024/12/30/nvidia-vs-amd-which-is-better-ai-chip-stock-2025/

-

CNBC. "Nvidia NVDA Earnings Report Q3 2025." November 20, 2024. https://www.cnbc.com/2024/11/20/nvidia-nvda-earnings-report-q3-2025.html

-

The Guardian. "Nvidia to Build $500bn of US AI Infrastructure as Chip Tariff Looms." April 15, 2025. https://www.theguardian.com/technology/2025/apr/15/nvidia-to-build-500bn-of-us-ai-infrastructure-as-chip-tariff-looms

Sources & References

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher