The ROI of AI: When Does Investment in Intelligence Pay Off?

A practical framework for evaluating AI investments and understanding when artificial intelligence initiatives deliver measurable returns. Exploring real-world case studies, common pitfalls, and the metrics that matter for assessing AI ROI across industries.

The ROI of AI: When Does Investment in Intelligence Pay Off?

The promise of artificial intelligence has captivated business leaders across every industry. From Fortune 500 companies to ambitious startups, organizations are investing billions in AI initiatives, hoping to transform operations, unlock insights, and gain competitive advantages. Yet behind the enthusiasm lies a more complex reality: not all AI investments deliver positive returns, and even successful implementations often take longer and cost more than initially projected. Understanding when and how AI investments actually pay off has become one of the most critical questions facing business leaders in 2025.

The challenge of calculating AI ROI goes beyond simple financial metrics. Unlike traditional technology investments where costs and benefits follow relatively predictable patterns, AI initiatives often require substantial upfront investment with uncertain timelines and outcomes. The path from proof-of-concept to production deployment is littered with challenges—data quality issues, integration complexity, organizational resistance, and the discovery that AI solutions don't always work as expected for real-world problems.

This analysis provides a practical framework for evaluating AI investments, examining when they deliver measurable returns, and understanding the factors that separate successful AI initiatives from expensive failures. By examining real-world case studies across industries and identifying the metrics that actually matter, we can develop a more nuanced understanding of AI ROI that goes beyond vendor promises and hype.

The True Cost of AI Implementation

Before assessing returns, we must understand the complete cost picture of AI implementation. Many organizations dramatically underestimate the total investment required, focusing only on obvious costs like software licenses or cloud computing while overlooking substantial hidden expenses.

Technology Infrastructure represents just the tip of the iceberg. Yes, organizations need to pay for AI platforms, cloud computing resources, specialized hardware like GPUs for training models, and various software tools. For significant AI initiatives, these costs can easily reach hundreds of thousands or millions of dollars annually. However, technology typically represents only 20-35% of total AI investment costs.

Data Preparation and Management often emerges as the largest hidden cost. AI models require substantial amounts of clean, labeled, organized data. Companies frequently discover that their data exists in silos across different systems, uses inconsistent formats, contains errors and gaps, and lacks the labels or structure that AI systems require. Addressing these data challenges—through data engineering, cleaning, integration, and labeling—can consume 40-50% of AI project budgets and timelines.

A major retail company's experience illustrates this challenge. The organization launched an AI initiative to optimize inventory across its supply chain. The initial budget allocated 60% to AI software and computing, 30% to personnel, and 10% to data. Within six months, the project team realized they needed to integrate data from 47 different systems, standardize product taxonomies that had evolved differently across regions, and correct years of accumulated data errors. Data-related work ultimately consumed 55% of the project budget and caused 18 months of delays.

Talent Costs represent another substantial investment. AI specialists—data scientists, machine learning engineers, and AI researchers—command premium salaries, often 50-100% higher than traditional software developers. Organizations need not just individual contributors but also managers who understand AI, business analysts who can translate business problems into AI opportunities, and engineers who can integrate AI systems with existing infrastructure.

Many organizations discover they need 10-15 different specialized roles to successfully deploy AI at scale, from data engineers preparing datasets to MLOps engineers maintaining models in production to change management specialists helping organizations adapt to AI-augmented workflows.

Organizational Change costs are frequently overlooked entirely in initial AI investment calculations. Implementing AI effectively requires training workers on new systems, redesigning business processes, managing resistance to change, and sometimes restructuring teams or even business models. These organizational costs—in time, attention, and resources—can equal or exceed the direct technology investments.

When properly accounting for all costs, most significant AI initiatives require 2-3 times the investment that initial technology-focused budgets suggest. Understanding this complete cost picture is essential for realistic ROI calculations.

The Timeline Reality: When Returns Actually Materialize

AI vendors and consultants often paint optimistic pictures of rapid returns, with proof-of-concepts delivered in weeks and production deployments in months. Reality typically looks quite different.

Phase 1: Discovery and Proof-of-Concept (3-6 months): Organizations typically start with an exploratory phase, identifying use cases, assembling teams, gathering initial data, and building prototype systems. During this phase, costs accumulate while returns remain zero. Even "successful" proof-of-concepts rarely generate business value—they merely demonstrate technical feasibility.

Phase 2: Development and Integration (6-12 months): Moving from prototype to production-ready system requires substantial engineering work. This phase involves building robust systems that handle edge cases, integrating with existing IT infrastructure, establishing data pipelines, implementing monitoring and maintenance processes, and addressing security and compliance requirements. Costs continue accumulating, often faster than in the POC phase, while returns remain minimal.

Phase 3: Initial Deployment and Iteration (6-12 months): When AI systems first go live, they rarely work perfectly. This phase involves debugging issues that only emerge with real-world data, retraining models based on actual performance, helping users learn to work effectively with AI systems, and incrementally improving accuracy and reliability. Some modest returns may begin appearing, but they're typically offset by ongoing costs and necessary refinements.

Phase 4: Scale and Optimization (12+ months): Only after systems prove themselves in production do organizations typically begin scaling them more broadly. This is when meaningful returns start materializing as AI systems process larger volumes, reach more users, or drive more decisions. Even in this phase, organizations continue investing in improvements and maintenance.

This timeline suggests that realistic AI ROI calculations should use a 3-5 year horizon rather than expecting returns within months or quarters. Organizations that evaluate AI investments with the same timelines they'd use for purchasing software typically abandon projects before reaching the point where returns materialize.

A financial services firm's fraud detection AI initiative provides a helpful example. The POC showed promising results after 4 months. Production deployment took another 14 months due to integration challenges and regulatory review. The first year in production, the system caught only marginally more fraud than existing rules-based systems while requiring substantial maintenance. In year two, as models learned from more data and processes matured, fraud detection improved significantly while false positive rates dropped. By year three, the system was delivering clear positive ROI. By year four, the returns significantly exceeded the total investment. An executive who evaluated this initiative at 12 months would have concluded it was failing; evaluated at 48 months, it was a clear success.

Success Patterns: When AI ROI Becomes Positive

While timelines vary, certain patterns characterize AI initiatives that successfully deliver positive ROI. Understanding these patterns helps organizations identify opportunities where AI investment is most likely to pay off.

High-Volume, Repetitive Decisions: AI excels at making the same type of decision thousands or millions of times. When organizations face high-volume, repetitive decisions that currently require human judgment, AI can often deliver clear ROI by automating these decisions or providing decision support that improves speed and accuracy.

A telecommunications company deployed AI to optimize network routing decisions. The system makes millions of micro-decisions daily about how to route traffic across the network. Even modest improvements in routing efficiency—reducing latency by milliseconds or improving bandwidth utilization by a few percentage points—multiply across millions of decisions to deliver substantial value. The AI system paid for itself within 18 months and continues delivering returns.

The key factors making this successful: high volume (millions of decisions), clear metrics (latency, bandwidth utilization), fast feedback (immediate results), and direct business impact (customer satisfaction, infrastructure costs).

Augmenting Expensive Human Expertise: When AI can augment or extend the productivity of expensive human experts, the ROI math often works favorably. The AI doesn't necessarily replace humans but allows each human expert to handle more cases, make better decisions, or focus on higher-value activities.

A medical imaging company deployed AI to assist radiologists in interpreting scans. The AI doesn't replace radiologists but pre-processes images, highlights potential areas of concern, and provides preliminary analysis. This allows each radiologist to review 30-40% more cases per day while actually improving diagnostic accuracy. With radiologists costing $300,000-500,000 annually, even a 20% productivity improvement delivers substantial returns.

Unlocking Existing Data Assets: Many organizations sit on vast quantities of data that have value but aren't being utilized due to scale or complexity. AI can unlock this value by finding patterns, generating insights, or enabling personalization at a scale impossible through manual analysis.

An e-commerce company deployed AI to personalize product recommendations using its database of billions of customer interactions. The data existed already; AI made it actionable at individual customer level. The implementation cost roughly $2 million including infrastructure, talent, and integration. Within two years, the personalization system was generating an estimated $40 million in incremental revenue annually through improved conversion rates and higher average order values.

Predictive Maintenance and Optimization: For organizations with expensive physical assets—manufacturing equipment, vehicles, infrastructure—AI that predicts failures or optimizes operations can deliver compelling ROI by preventing costly downtime or improving asset utilization.

An airline deployed AI to predict aircraft maintenance needs based on sensor data, operational patterns, and historical maintenance records. The system identifies components likely to fail soon, allowing planned maintenance rather than unexpected groundings. The ROI came from reduced unexpected maintenance events (each costing hundreds of thousands in lost revenue), optimized maintenance schedules (reducing unnecessary preventive maintenance), and improved aircraft availability (more flying hours per plane). The implementation cost $12 million; the airline estimates it saves $60-80 million annually.

Failure Patterns: When AI Investments Don't Pay Off

Understanding when AI succeeds is only half the picture. Perhaps more valuable is understanding common patterns where AI investments fail to deliver returns, as avoiding these pitfalls is often easier than engineering success.

Solution Looking for a Problem: Many AI initiatives begin with enthusiasm about the technology rather than a clear business problem. Organizations invest in building AI capabilities, then search for applications. This typically leads to deploying AI for problems that don't really require it, where simpler solutions would work fine, or where the problem doesn't matter enough to justify the investment.

A manufacturing company deployed computer vision AI to identify defects in products as they came off production lines. The technology worked, achieving 94% accuracy in detecting defects. However, the defect rate was already extremely low (less than 0.1%) thanks to modern manufacturing processes, and existing quality control caught nearly all defects anyway. The AI system cost $800,000 to implement but saved perhaps $50,000 annually in quality control labor. Negative ROI was inevitable.

Data That Doesn't Exist or Can't Be Used: Some of the most compelling AI use cases require data that organizations don't actually have, can't collect for legal or practical reasons, or can't use due to privacy, regulatory, or ethical constraints.

A healthcare startup built an AI system to predict patient health risks based on comprehensive lifestyle data, medical history, genetic information, and real-time monitoring. The AI models showed impressive results with test data. However, the company discovered that actually collecting this data from real patients was nearly impossible due to privacy concerns, regulatory restrictions, data scattered across multiple providers, and patient willingness to share information. The technical AI work was excellent; the business failed because the required data pipeline was infeasible.

Accuracy Insufficient for the Use Case: Some business decisions require extremely high accuracy for AI to be useful. When AI systems achieve 85% or even 95% accuracy but the use case requires 99%+, they fail to deliver value regardless of the impressive-sounding accuracy metrics.

A financial services firm deployed AI to automate loan approval decisions. The AI achieved 92% accuracy compared to human underwriters' decisions. However, the 8% error rate was unacceptable—it meant rejecting creditworthy customers or approving risky loans. The AI couldn't be deployed without human review, meaning it didn't actually reduce costs or improve speed. The project delivered no ROI despite impressive ML metrics because the accuracy threshold required for autonomous operation wasn't met.

Integration and Maintenance Costs Underestimated: Some AI projects succeed technically but fail economically because the ongoing costs of integration, maintenance, and operation exceed the benefits delivered.

A logistics company deployed AI for route optimization. The initial models showed 12% improvement in delivery efficiency. However, the AI required constant retraining as traffic patterns changed, frequent updates to integrate with evolving order management and dispatch systems, and substantial technical support to handle edge cases. The maintenance costs—approximately $400,000 annually—plus the integration overhead exceeded the operational savings. Three years in, the company had spent $2.5 million with minimal positive impact on the bottom line.

Organizational Resistance and Change Management Failure: Technical AI success doesn't translate to business value if organizations reject or work around the AI systems.

A professional services firm deployed AI to match consultants with client projects based on skills, experience, and availability. The AI worked technically, producing reasonable matches. However, senior partners resisted the system because it reduced their discretion in assignments and challenged existing political dynamics. They found ways to work around it, using the AI for appearances while making decisions through traditional channels. The AI investment delivered no value because organizational adoption failed.

The Metrics That Matter: Measuring AI ROI Properly

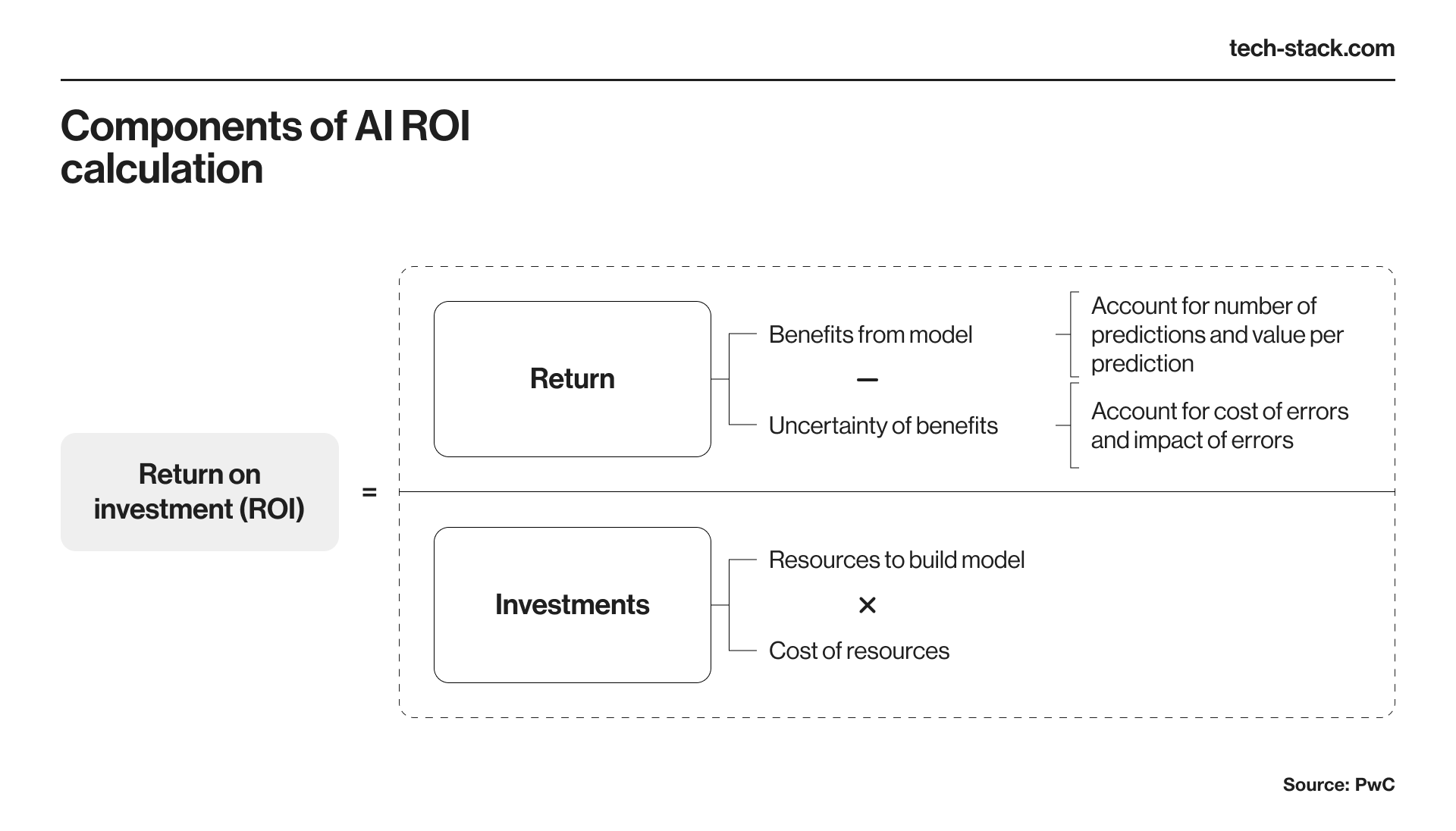

Measuring AI ROI requires moving beyond simple financial calculations to capture the complete value and costs. Different AI use cases require different metrics, but several principles apply broadly.

Distinguish Vanity Metrics from Business Metrics: AI projects often celebrate technical metrics—model accuracy, precision, recall, F1 scores—that may not correlate with business value. A model with 95% accuracy could deliver zero business value if it doesn't change decisions or behaviors in ways that matter.

Effective ROI measurement requires connecting AI performance to business outcomes. For a customer churn prediction system, the relevant metrics aren't just prediction accuracy but: retention rate improvement, cost per retained customer, revenue impact of reduced churn, and customer lifetime value changes. These business metrics may have complex relationships with ML metrics.

Account for Counterfactual Scenarios: Measuring AI value requires understanding what would have happened without the AI. This is often harder than it seems because organizations change in many ways simultaneously, and isolating AI's specific impact requires careful analysis.

Good approaches include A/B testing (where feasible), control groups not using AI, before-and-after analysis with statistical controls, and attribution modeling. Simply observing that performance improved after deploying AI doesn't prove the AI caused the improvement.

Include Total Cost of Ownership: Proper ROI calculations must include all costs over the relevant timeframe: initial development, infrastructure and computing, ongoing maintenance and improvement, integration and technical support, data acquisition and preparation, organizational change and training, and opportunity costs of team time and management attention.

Many organizations calculate AI ROI using only initial development costs, ignoring that a system costing $1 million to build might require $300,000-500,000 annually to maintain, integrate, and operate. Over five years, the total investment might be $3-4 million, not $1 million.

Consider the Appropriate Time Horizon: AI investments typically require 3-5 year time horizons for ROI evaluation. Shorter timeframes capture mainly costs; longer timeframes risk attributing unrelated changes to the AI investment.

The appropriate horizon depends on the use case and organization. Faster ROI is possible for simpler AI applications with clear business impact and minimal integration. More complex, transformative AI initiatives might require even longer horizons.

Quantify Both Direct and Indirect Benefits: Some AI benefits are straightforward to quantify: cost savings from automation, revenue increases from better predictions, or error reductions from improved accuracy. Other benefits are more indirect but potentially as important: risk reduction, improved customer satisfaction, employee productivity, faster decision-making, or strategic optionality created by AI capabilities.

Comprehensive ROI assessment attempts to quantify these indirect benefits where possible, acknowledging uncertainty, and considers them qualitatively when quantification isn't feasible.

Industry-Specific ROI Patterns

AI ROI varies significantly across industries due to different economic structures, data availability, regulatory environments, and use case characteristics. Understanding industry-specific patterns helps set realistic expectations.

Financial Services: Generally among the fastest positive ROI due to large volumes of transactions, valuable data, high costs of errors (fraud), and direct revenue connections (credit decisions, trading). Typical payback periods: 2-3 years for successful projects. Key success factors: data quality, regulatory compliance, model interpretability.

Healthcare: Mixed ROI picture with longer payback periods (3-5+ years) due to regulatory requirements, complex integration with clinical workflows, and conservative adoption patterns. High-value applications in medical imaging, drug discovery, and operational efficiency, but challenged by data interoperability issues and liability concerns.

Manufacturing: Strong ROI potential in predictive maintenance, quality control, and supply chain optimization. Typical payback: 2-4 years. Success requires good sensor data and integration with operational technology systems. Brownfield deployments (adding AI to existing facilities) face higher integration costs than greenfield.

Retail and E-commerce: Fast ROI (18 months - 3 years) for customer-facing applications like personalization, recommendation, and dynamic pricing due to direct revenue impact and abundant data. Challenges include rapidly changing consumer behavior requiring frequent model retraining.

Transportation and Logistics: Strong ROI (2-3 years) for route optimization, demand prediction, and dynamic pricing. Autonomous vehicle applications face much longer timelines (5-10+ years) due to technical, regulatory, and safety challenges.

Professional Services: Challenging ROI due to high value placed on human expertise, resistance to automation, and difficulty capturing sufficient data. Success requires focusing on augmentation rather than replacement and addressing change management proactively.

Strategic Considerations Beyond Financial ROI

While financial ROI matters, strategic considerations sometimes justify AI investments even when near-term ROI is uncertain or negative.

Competitive Necessity: In some industries, AI capability has become table stakes for competing effectively. Organizations might need to invest in AI not because ROI is clearly positive but because not investing means falling behind competitors. This mirrors earlier technology waves where internet presence or mobile capabilities became necessary regardless of precise ROI calculations.

Organizational Learning and Capability Building: Early AI projects might deliver modest financial returns but build capabilities, establish data infrastructure, and develop organizational knowledge that enables future projects with better ROI. This strategic learning investment rationale requires careful balancing—not every expensive learning experience is justified—but may explain investments that don't meet traditional ROI thresholds.

Defensive Innovation: Some AI investments defend existing business models against disruption rather than generating new value. A traditional company might invest in AI capabilities to match AI-native competitors, even if these investments initially cannibalize existing revenue or margins. The alternative—allowing competitors to establish AI advantage—could pose existential risks.

Option Value: AI investments can create options and strategic flexibility for uncertain futures. Building AI capabilities positions organizations to capitalize on emerging opportunities or respond to competitive threats, even if specific use cases aren't yet clear. This option value is real but difficult to quantify in traditional ROI frameworks.

Improving AI ROI: Practical Recommendations

Organizations seeking to improve AI ROI can apply several evidence-based strategies:

Start with Clear Business Problems: Begin with specific, important business problems, not with AI capabilities looking for applications. Frame initiatives around business outcomes—"reduce customer churn by 15%" rather than "deploy predictive models."

Set Realistic Expectations: Use 3-5 year horizons for ROI evaluation, plan for 2-3x initial cost estimates, and expect significant data and integration work. Realistic planning prevents premature project cancellation and disappointment.

Prioritize Data Foundation: Invest heavily in data infrastructure, quality, and governance before or concurrent with AI development. Many organizations should focus on getting data right before rushing into model development.

Design for Production From Day One: Don't treat production deployment as an afterthought to model development. Consider integration, monitoring, maintenance, and operational requirements from project inception. The "throw it over the wall to operations" approach rarely works for AI.

Measure and Iterate: Implement robust measurement from the start, tracking both technical metrics and business outcomes. Use this data to continuously improve systems and redirect investments toward what's working.

Address Organizational Change Actively: Treat change management as central to AI success, not as an afterthought. Engage stakeholders early, provide training and support, address concerns honestly, and design AI systems to augment rather than threaten workers where possible.

Consider Build vs. Buy Carefully: Building custom AI can provide competitive advantage but requires significant investment. For many use cases, purchasing AI capabilities from vendors or using cloud AI services delivers faster ROI despite less differentiation.

Scale What Works: After proving ROI in initial deployments, scale successful applications aggressively while killing or redirecting unsuccessful initiatives quickly. Too many organizations spread resources across numerous marginal projects rather than doubling down on winners.

The Future of AI ROI

As AI technology matures and organizations gain experience, AI ROI patterns are evolving. Several trends suggest improving returns for AI investments over time:

Decreasing Technology Costs: Cloud AI services, pre-trained models, and better tools are reducing the technical costs of AI implementation. What required custom development and significant ML expertise five years ago might now be achievable with no-code platforms and API services.

Improving Infrastructure: Better MLOps tools, standardized deployment patterns, and mature AI platforms are reducing the integration and maintenance costs that have plagued many AI initiatives.

Organizational Learning: As more organizations gain AI experience, they're developing better practices for scoping projects, managing data, and driving adoption—all improving ROI.

More Proven Use Cases: Early AI initiatives required pioneering new applications. Today, organizations can learn from proven use cases across industries, reducing risk and accelerating time-to-value.

However, other trends may work against improving ROI:

Increasing Expectations: As AI capabilities advance, stakeholders expect more from AI systems, potentially raising the bar for what counts as success.

Talent Competition: Growing demand for AI talent continues driving up labor costs, offsetting some technology cost reductions.

Regulatory Complexity: Increasing AI regulation adds compliance costs and can delay deployment or limit applications.

The net effect likely favors improving AI ROI over time, but success will still require disciplined execution, realistic expectations, and careful project selection.

Conclusion

The ROI of AI investments is neither automatic nor impossible—it depends critically on selecting appropriate use cases, executing implementations effectively, managing organizational change, and taking a sufficiently long-term view. The most successful AI initiatives typically share common characteristics: they address high-volume decisions or augment expensive expertise, they build on good data foundation, they focus on production readiness from the start, and they measure business outcomes rigorously.

For business leaders evaluating AI investments in 2025, the key questions aren't whether AI can deliver returns—it clearly can in appropriate circumstances—but rather: Do we have a clear business problem that AI is well-suited to solve? Do we have or can we acquire the necessary data? Are we prepared for the complete investment required, including data work, integration, and change management? Can we maintain realistic timelines and expectations? And are we measuring the right outcomes to understand if the investment is actually paying off?

Organizations that answer these questions honestly and execute accordingly will find that AI investments can deliver substantial positive ROI, typically materializing over 3-5 year horizons. Those that succumb to hype, underestimate costs, or expect magical results will likely join the large cohort of AI initiatives that consume resources without delivering returns.

The intelligence artificial intelligence provides has value, but extracting that value requires intelligence in how organizations approach, implement, and evaluate their AI investments.

This analysis is for informational purposes only and does not constitute investment or business advice. Organizations should conduct their own analysis based on their specific circumstances, and consider consulting with relevant experts when making significant technology investments.

Sources & References

- 1. "AI Implementation ROI Studies" - McKinsey Global Institute

- 2. "Enterprise AI Adoption Survey 2025" - Deloitte AI Institute

- 3. "Measuring AI Business Value" - Harvard Business Review

- 4. "AI Total Cost of Ownership Analysis" - Gartner Research

- 5. Various case studies from MIT Sloan Management Review

- 6. Industry-specific AI adoption reports from IDC and Forrester Research

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Markets and competitive dynamics can change rapidly in the technology sector. Taggart is not a licensed financial advisor and does not claim to provide professional financial guidance. Readers should conduct their own research and consult with qualified financial professionals before making investment decisions.

Taggart Buie

Writer, Analyst, and Researcher